Forex Trading Academy

Learn Forex

Learn Forex trading with our complete range of articles, profitable strategies, FX calculators, trading tools and more. Become a better trader today!

Forex Brokers

Read our comprehensive Forex brokers articles where we publish all the info needed to help you select the right one according to your trading strategy.

Calculators & Tools

Forex calculators set including pip calculator, position size and risk calculator, margin calculator, Fibonacci calculator, pivot point calculator.

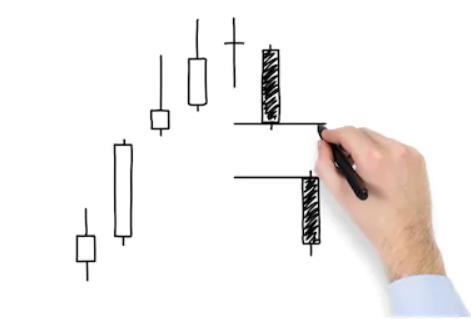

Technical Indicators

In our Forex Technical Indicators section you will find the instructions and tutorials on how to use the most common technical analysis indicators.

Forex Basics

In our Forex Basics dedicated section you will find all the information any beginner needs to start it's trading career in this exciting market.

MQL4

Learn what is an MT4 Expert Advisor and how to easily write and code one to accomplish your automated trading goals with our complete guide.

Training Videos

Browse our extensive library of Forex training videos full of great content. Get the right answers in a fun, interactive way with our multimedia tutorials.

Miscellaneous

Extensive library of Forex articles covering a wide range of topics; market sentiment, COT report, scalping, Martingale techniques and much more!