The Effects of the Japanese Economic Indicators in Forex Trading

Updated 13 April 2020

Learn in this article about the main Japanese economic reports and indicators including interest rates, inflation, employment and how they affect the Forex market.

The Japanese Economic Reports and Indicators

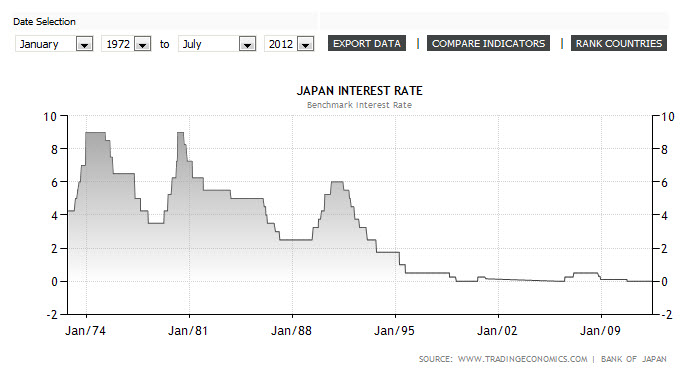

Interest Rates & Monetary Policy

| Report | Impact | Big Picture | Currency Effect | Description |

|---|---|---|---|---|

| BOJ Interest Rate Decision | Medium |  | if actual > forecast, bullish for JPY | Bank of Japan (BOJ) policy board members come to a consensus on where to set the rate. Traders watch interest rate changes closely as short-term interest rates are the primary factor in currency valuation. |

| BOJ Press Conference | High | if actual > forecast, bullish for JPY | BOJ press conference looks at the factors that affected the most recent interest rate decision, the overall economic outlook, inflation and insights into future monetary policy decisions. | |

| BOJ Governor Speaks | Medium | if actual > forecast, bullish for JPY | BOJ Governor is to speak. As head of the BOJ, which sets short term interest rates, he has a major influence over the value of the yen. Traders watch his speeches closely for subtle hints regarding future monetary policy and interest rate shifts. | |

| BOJ Monthly Report | Medium | if actual > forecast, bullish for JPY | BOJ monthly report contains the statistical data that policymakers evaluate when setting interest rates. The report also provides analysis of current and future economic conditions from the bank’s perspective. | |

| BOJ Monetary Policy Meeting Minutes | Medium | if actual > forecast, bullish for JPY | Are a detailed record of the Bank of Japan’s policy setting meeting, containing in-depth insights into the economic conditions that influenced the decision on where to set interest rates. | |

| Monetary Base (Y/Y) | Low | if actual > forecast, bullish for JPY | Measures the change in the total amount of domestic currency in circulation and current account deposits held at the Bank of Japan. An increasing supply of money leads to additional spending, which leads to inflation. |

Inflation

| Report | Impact | Big Picture | Currency Effect | Description |

|---|---|---|---|---|

| Tokyo Core Consumer Price Index (CPI) | Medium |  | if actual > forecast, bullish for JPY | Measures the change in the prices of a basket of goods and services purchased by consumers in Tokyo, excluding fresh food, and it is designed to measure price inflation. |

| National Core CPI (Y/Y) | Low | if actual > forecast, bullish for JPY | Measures the change in the prices of a basket of goods and services purchased by consumers, excluding fresh food, and it is designed to measure price inflation. | |

| GDP Price Index (Y/Y) | Low | if actual > forecast, bullish for JPY | Measures the change in the price of all goods and services included in the GDP, and it is the broadest measure of inflation and the primary indicator the BOJ uses to gauge inflation. | |

| CGPI | Low | if actual > forecast, bullish for JPY | Measures the change in the selling prices of goods purchased by Japanese corporations, thus measuring change in inflation rate from the perspective of the manufacturer and it is correlated with consumer price inflation. |

Balance of Payments

| Report | Impact | Big Picture | Currency Effect | Description |

|---|---|---|---|---|

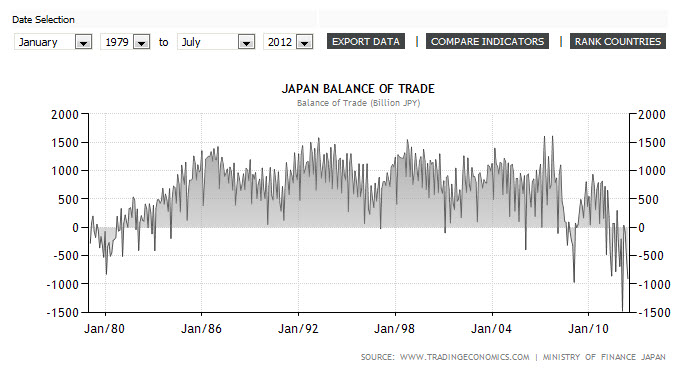

| Trade Balance | Medium |  | if actual > forecast, bullish for JPY | Measures the difference in value between imported and exported goods and services over the reported period. Trade surplus means that Japan is exporting more than its importing, which is good for yen. |

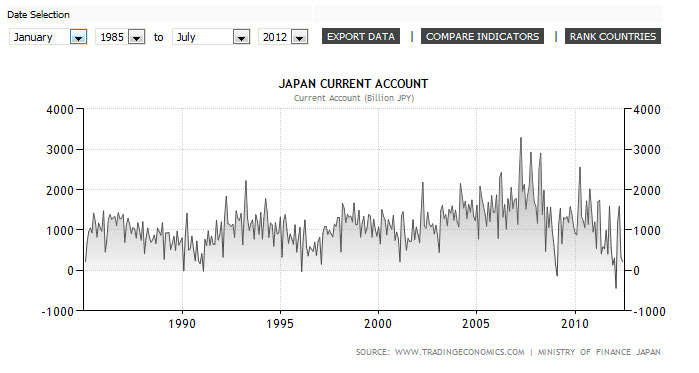

| Current Account | Medium |  | if actual > forecast, bullish for JPY | Measures the flow of goods, services, income and transfer payments moving into and out of a country. More money flowing into the country (a current account surplus) means more people have been required to buy yen. More money flowing out of country (a current account deficit) leads to currency depreciation because the currency is leaving the country to make payments in a foreign currency. |

| M2 Money Stock | Medium | if actual > forecast, bullish for JPY | Measures the change in the total quantity of domestic currency in circulation and deposited in banks. |

Employment

| Report | Impact | Big Picture | Currency Effect | Description |

|---|---|---|---|---|

| Unemployment | Medium |  | if actual > forecast, bearish for JPY | Measures the percentage of the total work force that is unemployed and actively seeking employment during the previous month. The data tends to have a muted impact relative to employment data from other countries because Japanese economy is more reliant on the industrial sector than personal spending. |

| Average cash earnings | Low | if actual > forecast, bullish for JPY | Measures the change in employment income, including bonuses and overtime pay. Higher income is positive for consumption. |

Economic Activity

| Report | Impact | Big Picture | Currency Effect | Description |

|---|---|---|---|---|

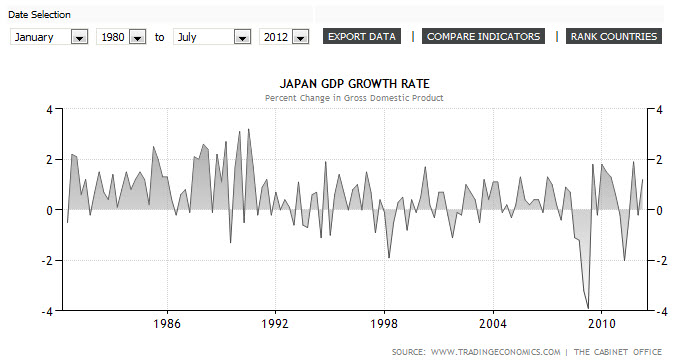

| GDP (Q/Q) | High |  | if actual > forecast, bullish for JPY | Measures the annualized change in the inflation-adjusted value of all goods and services produced by Japan. |

| BSI Large Manufacturing Conditions | Medium | if actual > forecast, bullish for JPY | Measures the business sentiment in manufacturing, and is a key indicator of the strength of the Japanese economy, which relies heavily on the manufacturing industry. | |

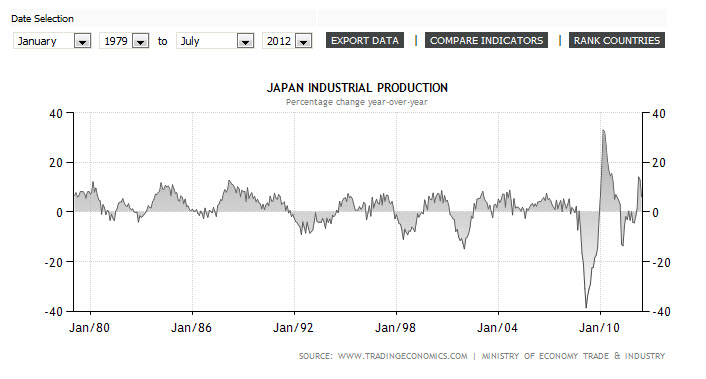

| Industrial Production (M/M) | Medium |  | if actual > forecast, bullish for JPY | Measures the change in the total inflation adjusted value of output produced by manufacturers, mines, and utilities. |

| Tertiary Industry Activity (M/M) | Medium | if actual > forecast, bullish for JPY | Measures the change in the total value of services purchased by businesses, and is a leading indicator of economic health. | |

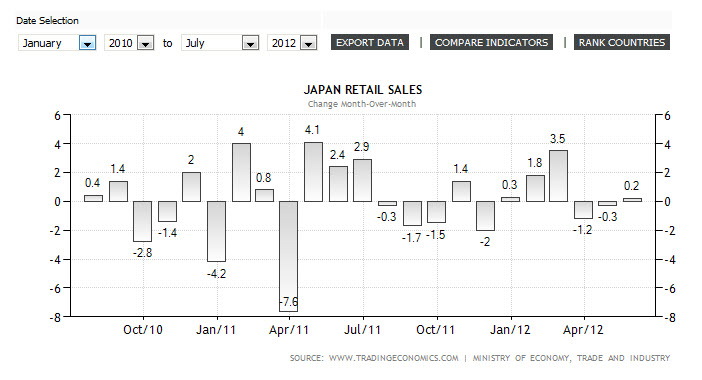

| Retail Sales | Medium |  | if actual > forecast, bullish for JPY | Measures the change in the total value of inflation-adjusted sales as the retail level and is the foremost indicator of consumer spending. |

| Leading Index | Low | if actual > forecast, bullish for JPY | It is a composite index based on 12 economic indicators, designed to predict the future direction of the economy. | |

| Machine Tools Orders (Y/Y) | Low | if actual > forecast, bullish for JPY | Measures the change in the total value of new orders placed with machine tool manufacturers. | |

| Core Machinery Orders (M/M) | Low | if actual > forecast, bullish for JPY | Measures the change in the total value of new orders placed with machine manufacturers, excluding ships and utilities. | |

| Manufacturing PMI | Low | if actual > forecast, bullish for JPY | Measures the activity level of purchasing managers in the manufacturing sector, with a reading above 50 representing expansion and below representing contraction. | |

| All Industries Activity Index (M/M) | Low | if actual > forecast, bullish for JPY | Measures the monthly change in overall production by all sectors of the Japanese economy. | |

| Household spending (Y/Y) | Low | if actual > forecast, bullish for JPY | Measures the change in the inflation-adjusted value of all expenditures by consumers. | |

| Housing Starts (Y/Y) | Low | if actual > forecast, bullish for JPY | Measures the change in the annualized number of new residential buildings that began construction during the reported month. |

Confidence and Sentiment Reports

| Report | Impact | Big Picture | Currency Effect | Description |

|---|---|---|---|---|

| Tankan Survey | Medium | if actual > forecast, bullish for JPY | Surveying some 10,000 + Japanese firms on their outlook, the Tankan is reported as a diffusion index, where negative responses are subtracted from positive responses, resulting in a net reading — the higher the Tankan index, the more optimistic the outlook. | |

| Economy Watchers Index | Low | if actual > forecast, bullish for JPY | Measures the current mood of businesses that directly service consumers, such as barbers, taxi drivers and waiters, compiled from a survey of about 2000 workers. A reading above 50.0 indicates optimism; below indicates pessimism. | |

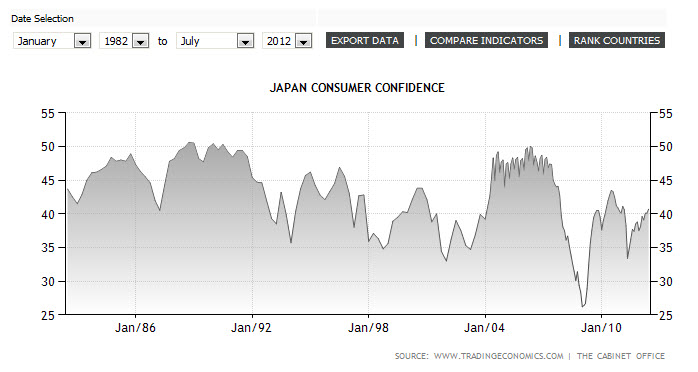

| Household Confidence | Low |  | if actual > forecast, bullish for JPY | Rate the relative level of overall economic conditions. |

Found the Japanese Economic Indicators? Read more about other Fundamental Indicators.

Is this article helpful? Share it with a friend

HTML Comment Box is loading comments...

Symbol Search

Symbol

Description

Sources

Simply start typing while on the chart to pull up this search box