Martingale System in Forex Trading

“He [Bond] was playing a progressive system (martingale) on red at table five. It seems that he is persevering and plays in maximums.”

- Ian Fleming, Casino Royale

Martingale and Gambling: The Illusion of Winning

At the height of 18th French Enlightenment, the gamblers practiced what looked like a revolutionary strategy called Martingale: The gambler doubles his bet after every losing coin toss until his first win recovers his losses plus profit. The theory rested on a simple idea that seemed sound on the surface: a gambler will eventually flip heads. Even when a player loses most of his bets, he can steadily build his profit because it just takes that one occasional win to make up for all the losses. Joie de vivre! Oh, la la! It seemed to be the holy grail of its time.

Well, not quite. None of the French gamblers ever became rich with the strategy and many certainly became poorer. What they didn’t quite know at the time was that there are TWO problems using martingale with games of chance and gambling: the probability of a losing streak rises the more one’s bets, and no one has infinite wealth to withstand a large losing streak.

First Problem: every next result is completely independent of the previous results, so the streak of any number of losses is totally possible. Moreover, while it is true that the odds of having more than 5 multiple losers in a row are low, the more betting that is done the greater the odds of having such a losing streak.

Let us imagine that our roulette gambler has $1000 and sticks to a principle of withdrawing from the bet after 6 consecutive losing trades, under the assumption that such a scenario is rare. With $10 wager amount, and a doubling each wager after every loss, 6 doubles represent a sum of $630, his worst case scenario because it represents over half his money brought to the table. In the roulette table, where the odds of losing in a single spin is 52.63%, the odds of losing 6 times in a row is 2.12%. That does seem small.

However, the more you spin, the greater your odds of losing 6 times in a row: 73 spins=50.3%, 150 spins=77%, and 250 spins= 91.1% chance of such a streak. In a simple coin toss where the odds of losing once is 50%, the odds of a six-time losing streak are only a slightly better: in 150-coin tosses, there is a 70.75% chance of losing 6 times in a row.

As you can see, it does not take that many bets before the odds of losing 6 a row becomes very probable, and what you have made from winning bets in between will not be enough to offset the one loss. Martingale thus poses no threat to the casino because of the higher odds the gambler will go broke before he is able to double his money.

Second Problem: even if the gambler can bet for days and has the wealth to withstand more than 6 losers in a row, no gambler in the world is possessed of infinite wealth to withstand the exponential growth of more than 20+ losers in a row.

James Bond (in the quote above) probably had considerable wealth to martingale on the roulette table and he was also a very lucky bloke who could bet big without worry. Your average millionaire would not fare as well. If a cautious millionaire started to bet $1 per trade, he would need only 20 losing trades in a row to have $1,050,000 in losses (see table above). Not too many millionaires could withstand that. Even if the gambler had the wealth of 9 trillion, he would be broke by the 43rd losing bet. Sure, the statistical probability of losing 20-43 consecutive tosses may be remote, but the point is clear. If your bet size is double the last, no matter if you started at just $1, the negative compounding becomes insane. No rich dude is going to jeopardize his fortune for the sake of doubling his initial $1–not even if he could do that repeatedly.

Martingales and Forex: Better Odds than Casinos (and other Markets)

Martingale system in Forex trading: Better odds than casinos? Learn everything about this gambling technique including mechanisms and disadvantages. Many FX traders think that Martingale can indeed fail in games of chance, and most definitely in casinos which have the odds stacked in their favor, but Martingales engaged in Forex can be less risky for a number of reasons:

Reason #1: Systems or traders with superb entry accuracy (outfitted with a Martingale trade management component) can push the odds of winning in their favor, and consequently, considerably lower the odds of facing bad losing streaks that jeopardize the account.

Traders are smart enough to realize that a casino has the odds tipped in their favor (52% or more loss per bet factor), and thus martingale gamblers will lose there eventually because of the higher likelihood of losing streaks. They even realize that in the 50/50 scenario of a coin toss, the odds of a losing streak are still too great when more flips are made.

But what if the trader or system can demonstrate a 65% or greater entry accuracy, and then combine such a system with a carefully calibrated martingale trade management component, then wouldn’t the odds of a losing streak be so much less? The idea is worth some consideration. Perhaps a highly accurate entry system combined with a correctly geared martingale can have a considerable edge over a pure martingale played out in the casino or Forex.

It is might be difficult but not impossible to engineer. Note: this approach would be much different than applying a pure “dumb” martingale to Marti-grid the market; such an approach would surely fail. See Modified Martingale.

Reason #2: Doubling down is the best way to lower average entry to breakeven.

A grid system can help lower average entry to breakeven, but a Martingale system can do so much faster, no matter how many intervals down. For instance, let us use a Martingale with a multiple of 2 with interval legs of 40. If you had taken the first position of 1 lot buy on EUR/USD at 1.3080 and the market moved against your initial by 40 pips, then you would have the second position of 2 lots at 1.3040.

You would only need the market to rally 20 pips, or half the distance between the two positions, to breakeven at 1.3040. If the market moved 40 pips lower to 1.3000 and you added a third position for 4 lots, then you would only need the same 20 pips rally in order to breakeven (and the ability to breathe once again!).

This 20-pip recover level remains consistent down through the intervals. Given the intraday fluctuation of most currencies, it becomes harder to have instances when a currency can power through 200+ pips without at least a few 20-pip corrective moves in between. Just one corrective move can bring the account to breakeven and you would be safe and secure, out of the game to wait for the next opportunity. In the grid system, without the martingale multiple factor, breakeven would always be the equal distance between the initial entry and the last interval and thus so much harder to get to the further down in intervals the market has moved.

Reason #3: Currencies rarely go to zero.

Companies can go bankrupt but countries cannot. There may be times when the economy of a country can be judged worse relative to another, and this will make a currency pair slide considerable ways down, but such a fall will take a long time over a number of vacillating moves, and the currency value will never reach zero. If you had been on the wrong direction of such a slide, it would hurt you for sure, but depending on the degree of vacillation on the way down, you still might have been able to get out at a breakeven point on a corrective uptick (illustrated above).

Reason #4: The flexibility of lot sizes and lower margins can make martingale much less risky for currencies than for stocks and futures.

With stocks and futures, the size of your trade, your minimum trade size, margin and leverage are all more or less fixed, and fixed at such a high amount that it would make it infeasible for the average trader to hold one position against an adverse market move, let alone several Marti-multiplied positions. A futures gold trader would need millions to martingale a standard gold contract more than 5 levels deep.

Forex, in contrast, has the luxury of much lower lot sizes with lower margins. Forex traders can trade the lowest of lot sizes, either a micro lot or nano lot (with a margin of $2.5 for micro and $0.25 cents for nano), and this lot size could in effect represent a deleveraged scenario relative to his account size. For instance, if the trader had a $5,000 account, his use of a micro lot would represent 1:5 leverage (he would be using far less than his potential 200:1 leverage), and so he would have plenty of usable margin to be able to kick out multiple Marti-legs in the attempt to free himself from a losing trade.

Reason #5: Positive overnight interest from positive interest bearing currencies can help offset losses.

This is probably the weakest of the four reasons but it is worth mentioning. A martingale trader can apply the strategy on currency pairs with positive carry, meaning he would buy a currency with the highest interest rate. For instance, as of July 2010, he would probably buy AUD/USD because it had the highest interest rate.

However, it should be remembered that the positive overnight interest can only weakly mitigate a losing martingale trade. A badly placed martingale suffering through multiple negative legs is like a house on fire: the hope that the positive overnight interest can offset the loss is akin to turning on the bathroom tap in the hopes it will drown out the house fire.

What are the Mechanics of Martingales in Forex?

There are six main components (account size, initial lot size, interval, profit target, multiple and max trades), as illustrated below:

| Components | Example |

|---|---|

| Account Size | $10,000 USD |

| Lot Size | 0.1 |

| Interval or Step | 20 pips |

| Profit Target | 20 pips |

| Multiple | 2 |

| Max Trades | 8 |

Your initial lot size relative to your account should be as low as possible for withstanding an adverse event. Your step interval and profit target should be small enough to double down to breakeven at the most frequent opportunities, yet large enough to withstand the shock of a fierce market event. Your multiple should be anywhere from 1.1 to 2 (if 1 then it would be a grid). Always aim lower in order to avoid the risk of negative compounding. Max trades should be set to a number that, if reached, would be your largest tolerable max open drawdown.

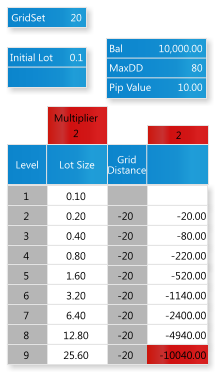

Let us look at an example of trading EUR/USD with a pure martingale a without a breakeven component. You start with $10,000 and decide to trade an initial lot size of 0.1 mini with a profit target of 20, interval of 20, multiple of 2, and max trades of 8. You place one 0.1 buy on EUR/USD at 1.3700 with 2 possible outcomes: if the market reaches your profit target, then you score $20; if it falls against you, your level 2 position is waiting at 1.3680 with 0.2 lots (for a total of 0.3 lots).

At that point you have another 2 possible outcomes: if the market moves from level 2 to 1, you profit again with $20; if it falls from level 2 to 3, you have a third position open at 1.3660 with 0.4 lots (for a total of 0.8 lots). This scenario repeats itself down through the eight intervals (your max trades). If the market reaches your eighth interval/level without a 20-pip correction, you would then find yourself holding a total of 25.6 open lots and in open position drawdown of $4940, or half your account.

Since every 10 point move thereafter would cost you an additional $256 (25.6 lots X $10), you would be wiped out in 20 more pips at the ninth level (see table on left). Most of the time the markets just need an uptick of 20 pips for you clear your profits off the board, and so most of the time your equity is steadily climbing upwards. However, if the market moves 200+ pips without correction, which it does from time to time, then your account is decimated.

Tip! A very handy Forex-Martingale calculator can be downloaded here.

What are the disadvantages of Martingales in Forex?

The upside of a Martingale EA is “no loss” and the downside is a colossal loss: The martingale EA can have no losses for some time due to “doubling up” after losing trades until the market turns around and position recovers, but if the market fails to turn around the doubling down quickly destroys the account.

Martingale trading systems are very popular in Forex automated trading because it’s quite easy to create an expert advisor that would look interesting and attractive using martingale. A system developer can back-test his martingale idea on an optimal history to show charming results, and with a bit of luck, he can even show equally charming forward results for a number of weeks or months. Adding a martingale is the easiest way to deceive oneself or an observer by providing a “profitable” (at least at the first glance) strategy. And then when he has lured himself or his friends into the idea of his holy grail, trading real money, one wrong trade can carry them all away.

Let’s list some of the inherent disadvantages in more detail:

- Classical or pure martingale is destined to fail – and fail probably within weeks or months. Using a pure martingale on the markets makes the probability of a losing streak no different than gambling. The probability becomes higher the more trades conducted. Strong trends of 200+ pips without significant corrections can happen, and when they do, they can usually pile up 8+ interval losing streaks that can quickly blow most accounts.

- Risk to Reward is too high. Suppose you are proposed to choose: gain 1 dollar with the probability of 99% or lose 99 dollars with the probability of 1%. Insignificant profits will be compensated with disastrous losses and disturbances. Doesn’t sound so appealing, does it?

- Creation of a fool’s paradise. For a short time, a martingale trader can see his account grow charmingly. He then thinks he is Midas himself and gets everyone around him to join his system until eventually, everything goes bust.

- Difficult to properly back-test or forward test. Martingales can easily reveal great backtest results over a narrowly defined history, and forward tests can similarly exhibit excellent results for weeks and months until the wrong trade eventually undoes everything.

- No-stops is a problem in itself. Most systems fail miserably without having well defined stops. The inseparable companion of no stops is overstaying the position. Within this time, the price sometimes runs very far away.

What possibly could be the antidote to the inherent disadvantage of a pure Martingale?

The Modified Martingale Trading: An “accurate” entry system married to a “conservative” martingale

Most traders who hold out for Martingales think that if they can find a good system with a very low record of consecutive losses, then it can be enhanced with a conservative martingale.

| Excellent Entry System | Conservative Martingale |

|---|---|

| High Accuracy. > 70% win ratio | Lowest possible Lot sizing and leverage (see reason #4) |

| Low Consecutive losing trades. | Low multiple |

| Properly calibrated leg interval |

The marriage of such a system should be able to prove its survivorship and profitability over a large trade sample size (back-testing and forward testing), ideally over a 9-year back-testing period that takes into account a range of different market conditions.

A highly accurate system would hope to make most of its money from the initial trade in trending markets, and it would use its martingale’s legs to make all trades profitable, even in range-bound or whipsaw markets. Most market conditions would thus be accounted for.

The only Achilles Heel would be the possibility of being on the wrong side of a very fierce trend or trend reversal, which could theoretically breach all the legs and explode the account. However, this is where the conservative calibration of the martingale can come in handy.

If the lot size was very small relative to account size (say, on a scale of 1:5 leverage), and the multiple was 1.5 (instead of 2), and the leg interval was set up to span a significant pip range, then the martingale would have a fighting chance to survive a drop through many intervals, even in a worst-case scenario.

If it can be shown through many trades in back-testing and forward-testing that the such a system has very few consecutive losing trades and that it can successfully sidestep or absorb most fierce market conditions, then the modified martingale would not necessarily be a waiting time-bomb.

There have been many attempts to create these modified martingales and most have failed. Sometimes the fault lies with the entry mechanism being not accurate enough, or the intervals or leverage or multiple not being adjusted correctly. The fault compounds with improper optimization and testing. However, because no one has created a successful modified martingale before does not make it impossible.

There have been many attempts to build a plane before the Wright Brothers came along. The quest for a successful modified martingale is a difficult one because it is very difficult to anticipate and sidestep that one Tsunami market event that might overwhelm all your levels. You might be able to do so for many of them but the key is to be able to do so for all of them.

Though proper back-testing and forward testing can help, the markets are generally random, and future randomness can throw the wildest things at a currently accurate system with very low consecutive losing trades.

Conclusion

A pure martingale, as we have seen, offers no better prospects at trading in FX as it does in casinos or games of chance. Without good entry positioning and directional bias, the pure martingale is a “dumb” time bomb waiting to explode the account at the first adverse market advent. You can Marti-grid the market for only so long before the market breaches all Marti-grid levels, and the faulty tower comes crashing down.

Modified martingales, on the other hand, can make “smart” directional trades with more precision when combined with an accurate entry system. This can help to mop up the miss rate and losing streaks and thus lessen the overall vulnerability of the system. Moreover, the martingale component can be far more conservative than traditionally imagined. One can trade with a very small lot size, deleverage, and greater leg intervals to withstand fierce events when they do occur.

Nevertheless, one should never forget the ever-present danger that still exists even within the best of modified martingales. No matter how accurate the system and how properly calibrated the martingale mechanism, it just takes that one freak trade to destroy your account. These modified martingales can be fun to play and experiment with – in demo accounts—or live accounts you can afford to lose. As long as you know the dangers of the beast you are about to ride, it can be an exhilarating ride as you see your equity climb like no other. Maybe you can be the lucky one that rides the beast to the gates of heaven. Alternatively, you may join the ranks of many others if it goes to hell. Hang tight, enjoy the ride, and be prepared for either event.