3 Professional Forex Trading Strategies That Work

Data is continually updated by our staff and systems.

Last updated: 13 Sep 2021

We earn commissions from some affiliate partners at no extra cost to users (partners are listed on our ‘About Us’ page in the ‘Partners’ section). Despite these affiliations, our content remains unbiased and independent. We generate revenue through banner advertising and affiliate partnerships, which do not influence our impartial reviews or content integrity. Our editorial and marketing teams operate independently, ensuring the accuracy and objectivity of our financial insights.

Read more about us ⇾

Most of the times when people talk about forex trading strategies, they refer to a specific trading method that is usually a part of a complete trading plan. On a professional forex trading strategy, it is vital to consider 3 key variables; money management, position sizing and risk management.

Table of Contents

When it comes to adjudicating what is the best and most profitable forex trading strategy all around, well, there is no single consensus. And here's why. Forex strategies are suited to the individual trader, meaning, you also need to consider your personality and trading style. So, you will have to find out which one suits you. What can work well for someone else may be a disaster for yourself.

On the other hand, a strategy that is not so popular with the others may turn out to be the right one for you. One of the main variables to consider is a timeframe for your trading style. But the topic of this article is 3 professional forex trading strategies that work. And that’s what you can find out with our extensive article, covering trendlines, pivot points and more!

We will not write about the basics of trading, like money management, position-sizing, etc., but if you need to learn more about the forex basics before diving into this article, just head over to our Forex Academy pages and take a quick look at our rich knowledge base.

Trendlines trading strategy

Trendline trading is a powerful method to take advantage of numerous trading opportunities. Markets can trade in a horizontal range, but often they go up or down diagonally, forming uptrends and downtrends, that can be used to plot the trendlines.

How to plot a trendline?

Traders are always trying to find the asset’s trend and plotting a trendline onto a chart is the easiest way to quickly see the asset’s trending direction. A trendline is a diagonal line that starts at the beginning of a trend and stops at the end of the trend.

You can draw one by using the MT4’s built-in trendline tool to plot them. However, finding where to start and stop the trendline can be tricky, so we’ll help with how to spot them, plot them, and interpret them. In general, we aim to start and stop the trendline at obvious highs and lows.

Before that, two aspects to consider. First, chart timeframe. Bear in mind that each timeframe can show different movements and different trends. Some trends are forming, others are continuing, some are breaking and others are reversing. Charting is a dynamic process. The weekly TF can show an uptrend while the H4 TF can show a downtrend.

Secondly, you may not be able to see or place a trendline on certain charts. Currencies are not trending constantly, sometimes they may be caught in directionless range or channel. Some trends can be orderly and easy to spot, while others can be disorderly and harder to see.

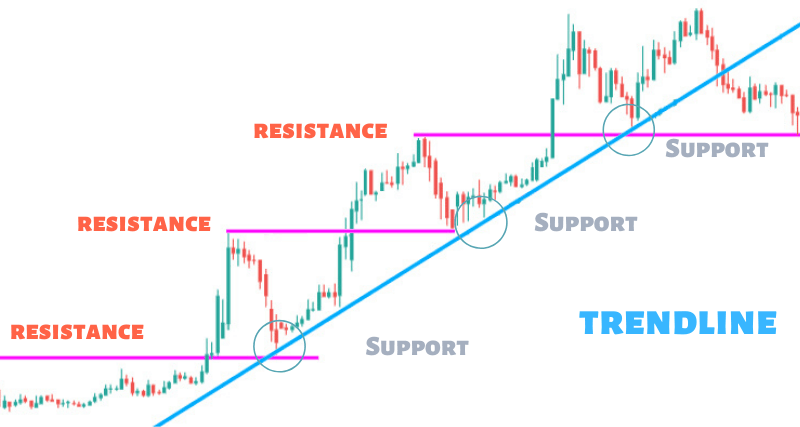

To draw an uptrend trendline, first, spot an obvious low and carry your eye along with higher highs and higher lows to an obvious high. Take a look at the chart. The first line, starting from the left, starts at a low and ends at a high. In general, upward sloping trendlines are used to connect prices that act as support while the given asset is trending upward. This means that upward sloping trendlines are mainly drawn below the price and connect either a series of closes or period lows.

Start at the lowest low and connect the line to the next low that precedes a new high. As long as the new highs are being made, redraw the line to connect to the lowest low before the last high. When prices start making new highs, stop drawing. Extend the line out into the future at the same slope. The upward trendline illustrates the support line. It’s named support because you expect the line to support the price – traders won’t let the price fall below it.

To draw a downtrend trendline your eyes should start at an obvious high and follow successively lower highs and lower lows to an obvious low. A downward sloping trendline is generally used to connect a series of closing prices or period highs that act as resistance while the given asset is trending downward.

Start at the highest high and connect the line to the next high that precedes a new low. As long as the new lows are being made, redraw the line to connect to the highest high before the last low. When prices stop making new lows, stop drawing. Extend the line out into the future at the same slope. The downward trendline illustrates the resistance line. It’s named resistance because you expect the line to resist the price–traders won’t let the price go above it.

Note: For purposes of drawing trendlines, use the highs and lows, but don’t ignore the close. It is possible to get a wild random move that creates a spike high or spike low that isn’t consistent with the overall trend.

Trading the trendlines strategy

This strategy offers numerous opportunities to get on board an ascending/descending trend at decent price levels. You have probably seen many pairs take off in one direction for a sustained period but have been too shy to get on board because of the fear that of getting in too late. However, if you plot your trendlines correctly, you can take advantage of buying from the support and selling from the resistance.

Trendlines trading strategy rules:

| Entry & Exit Rules | Long | Short |

|---|---|---|

| Entry Rule | Buy when the low of the bar reaches within a predefined number of pips of the support trendline. | Sell when the high of the bar reaches within a predefined number of pips of the resistance trendline. |

| Stop-Loss Rule | Exit the buy position when the low of the bar falls below the support trendline by a predefined number of pips. | Exit the sell position when the high of the bar reaches above the resistance line by a predefined number of pips. |

| Take Profit Rule | It can be the nearest level of resistance according to pivot point levels or depending on the risk-reward ratio used. | It can be the nearest level of support according to pivot point levels or depending on the risk-reward ratio used. |

Let’s look at two practical examples of how to use the trendlines trading strategy:

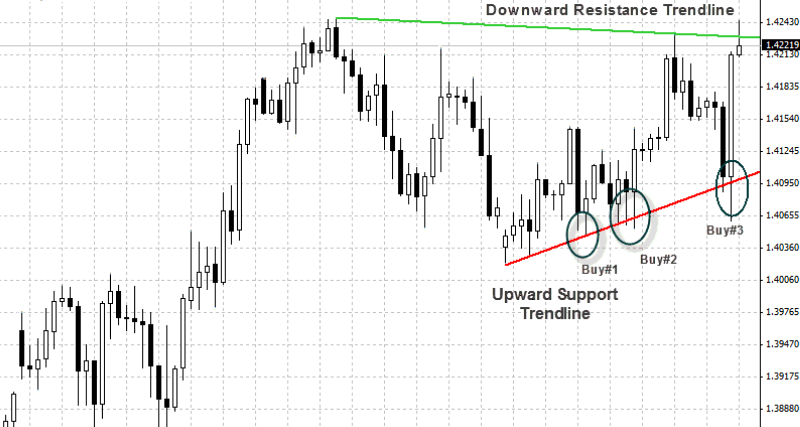

On the above example, you can see that the EUR/USD bull trendline had begun to form at the first significant low and the next higher low had confirmed it. The third low, which we named Buy #1, could have been a nice spot for traders to take up buy positions, but for most traders, it would have represented another confirmation point for the trendline support.

After that point held firm traders would have drawn and highlighted the support trendline above, and put in buy limit positions at Buy #2. Then, it would have looked like the trendline would never be touched again, as it was so far above. However, the traders had charged back to retest this trendline one more time, at Buy #3, and when it held firm, the price shoots up to its former highs

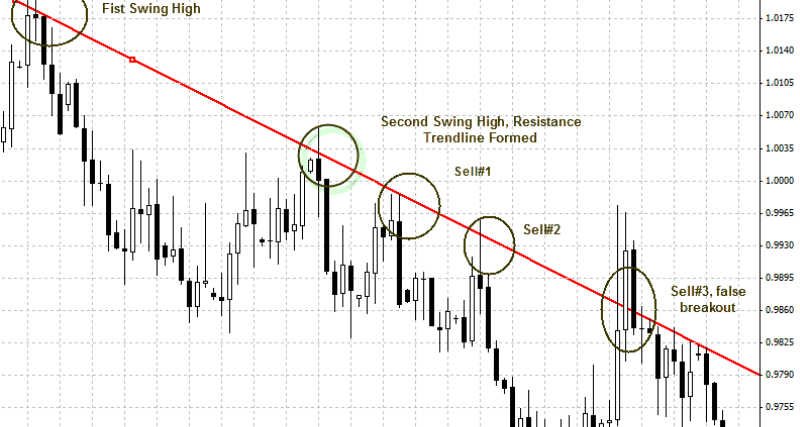

On the second example, the USD/CAD has been in a steep downtrend. It starts with the first swing high and gets the second swing high allowing to plot the downward trendline resistance.

Trendline traders would have drawn the same trendline and taken short positions at the approximate area of the trendline. The first short position, which we named Sell #1, allowed traders to successfully enter the market.

The second short position (Sell #2) followed in the same month and allowed traders to take the market to an even greater low of +300 pips. The third short position (Sell #3) would have been much trickier to stay on board without getting stopped out. The breakout traders would have seen the USD/CAD penetration of the trendline as an opportunity for a breakout, and they too would suffer from this trade as it would prove to be a fake breakout.

The trendline trading strategy helps traders enter or stay in a trend. When any part of the price bar penetrates the line on the downside, support may have been broken, or the trendline becomes unreliable.

If the move continues to the upside after the trendline is broken, the trendline becomes unreliable. A breakout is any part of the price bar penetrating a line that you drew on the chart. Some traders require that to qualify as a breakout, the bar component that breaks the line has to be the close.

Sometimes the offending breakout is quickly roped back into the herd, but usually, a breakout means that the trend is changing direction, either right away or sometime soon.

Ideally, once you have mastered how to draw good trendlines by hand or via automated indicators, you can zoom in and out on multiple time frames, searching for the time frame where it looks like traders are lining up to push the downward trendline support or pushing an upward trendline resistance.

To better determine if you should be taking bounces or breaks from these identified trendlines, you should be first familiar with the trend taking place on the larger time frame. If the technical and fundamentals suggest that the larger trend is up, you would best to look for bounces from upward trendlines or breakouts from downward trendlines on smaller time frame intervals.

If the technical and fundamentals suggest the larger trend is down, you would best to look for bounces from downward trendlines or breakdowns from upward trendlines on smaller time frame intervals. Every once and while there is a break or bounce from a daily time frame itself, and if a definite break occurs, you should be prepared to switch gears; that is, if you were formerly bearish, you will become bullish, and vice-versa.

The daily bar break is a powerful break, and a lucky opportunity if you can find it. However, if you miss the initial breakout of the daily bar, you can always play the retest, the pullback to the support or resistance bar that was just broken, allowing traders who did not get in on the initial breakout a second chance to get in.

You would then have the benefit of having former support become resistance, and the former resistance becomes support. Once the new trend continues, you can always take advantage of the bounces or breaks on smaller time frames in the direction of the new trend until the next breakout/breakdown of the daily trend.

Trendline trading calls for the instincts of a hunter, inclining one to follow the path of the larger trend, at the same time tracking the zigs and zags of different time frames, trading the bounces from “strong” trendlines and on the breakouts of “weak” trendlines. If you wish to learn more about this strategy, and other variants, read our in-depth article about the Trendlines Trading Strategy.

Support and resistance trading strategy

Support and resistance represent the backbone of technical analysis. They are the two most highly discussed topics of technical analysis and every serious trader should know how to identify and use them properly.

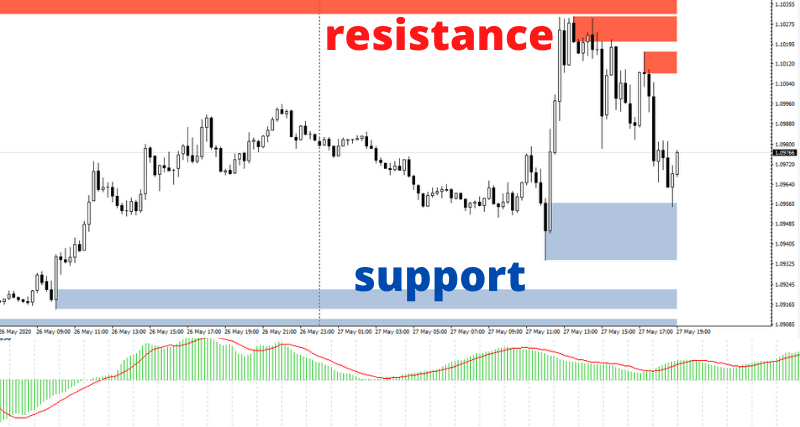

These two terms refer to the price levels that tend to act as barriers, preventing an asset’s price from getting pushed in a certain direction beyond a certain point. There are many different ways to determine the support and resistance levels, like using the recent price action or the pivot points formula. For our strategy, we are going to focus on price action.

In its simplified form, horizontal support and resistance look something like this:

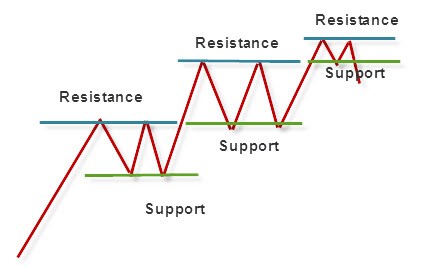

On a long trend, it’s a zigzag pattern and when the market moves up and then pulls back, the highest point reached before it pulls back is called resistance (blue line), while the lowest point reached before the market jumps back up is called support (green line).

If the market is bound within support and resistance lines, it’s called being in a range and in the above diagram, there are three of them. Within each range, the longer the market retests or confirms each level of support or resistance, the stronger each level is said to be.

Trading the support and resistance levels strategy

The logic behind the support is that as price declines towards support and gets cheaper, buyers become more inclined to buy and sellers become less inclined to sell. Conversely, the logic behind resistance is that as price moves up towards resistance, sellers become more inclined to buy and buyers become less inclined to buy.

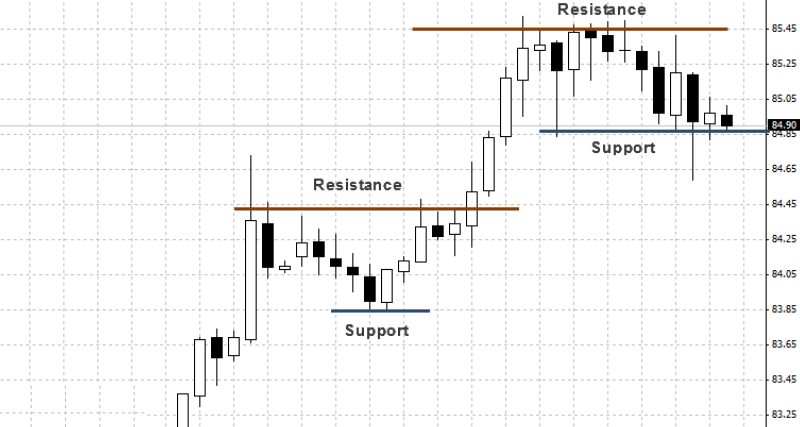

Once support or a resistance level is broken, other levels will have to be established, perhaps at a former support or resistance levels. When support is broken, it becomes new resistance, providing backup for your short trades and when a resistance level is broken, it becomes new support, providing backup for your long trades.

Support and resistance levels can be drawn using the horizontal line object tool in MT4. You can insert this horizontal line along with the highs and lows of the trading range, wherever it seems that the market had hit a level and bounced back again. Make sure your horizontal touches these highs or lows more than once. The more retouches (called retests) of these levels, the stronger is the support/resistance level.

Support and resistance levels trading strategy rules:

| Entry & Exit Rules | Long | Short |

|---|---|---|

| Entry Rule | On an uptrend buy on bounces of a support level. On an uptrend buy on breakouts of a resistance level. | On a downtrend sell on breakouts of a support level. On a downtrend sell on bounces of a resistance level. |

| Stop-Loss Rule | SL below last support level | SL above last resistance level |

| Take Profit Rule | TP depending on the risk-reward ratio used. We recommend 2:1 ratio. | TP depending on the risk-reward ratio used. We recommend 2:1 ratio. |

The key to successfully trade the support resistance strategy is to always trade with the trend. The trend is your friend, and a zoom out to the daily picture can give you an idea of the trend direction. If you wish to learn more about this strategy, read our in-depth article about the Support and Resistance Trading Strategy.

Pivot points trading strategy

A pivot point in trading is the sum of an asset’s previous trading day high, close and low prices, divided by three. On the following trading day if the asset’s price is below the pivot point it can signal an ongoing downtrend, while if the asset’s price is above the pivot point it can be interpreted as an ongoing uptrend.

The major advantage for this strategy is that it is a very common one, as so many traders, including the large institutional professional traders, are using the same levels based on the same formula. There is no discretion involved. In contrast, the method of drawing support and resistance levels and trendlines can be more subjective and impressionist as every trader can notice and draw different lines.

The reason why pivot point strategies are so popular is that those levels are predictive as opposed to lagging. Traders use the information of the previous trading day to calculate the reversal points, or breakout levels, for the current trading day.

How are pivot point levels calculated?

The formula Pivot Point = (High+Close+Low)/3 maps out the pivot point levels consisting of the pivot and three levels of support and resistance. These levels can be traded much the same way as trading from the regular support and resistance levels and trendlines, using a mix of breakout and bounce trading strategies. Here’s how it is calculated:

| Pivot level | Formula |

|---|---|

| Resistance 3 = | High + 2*(Pivot – Low) |

| Resistance 2 = | Pivot + (R1 – S1) |

| Resistance 1 = | 2 * Pivot – Low |

| Pivot Point = | ( High + Close + Low )/3 |

| Support 1 = | 2 * Pivot – High |

| Support 2 = | Pivot – (R1 – S1) |

| Support 3 = | Low – 2*(High – Pivot) |

These are the complete 7 pivot points of an asset’s price: the pivot point, 3 resistance levels, and 3 support levels. The three most common levels are the PP, R1 and S1. There are many MT4 indicator’s that can plot and automatically calculate these levels and drawing them on your price chart.

There are several ways to trade with these calculated pivot points but we will focus on the pivot point break trading strategy.

Trading the pivot point break strategy

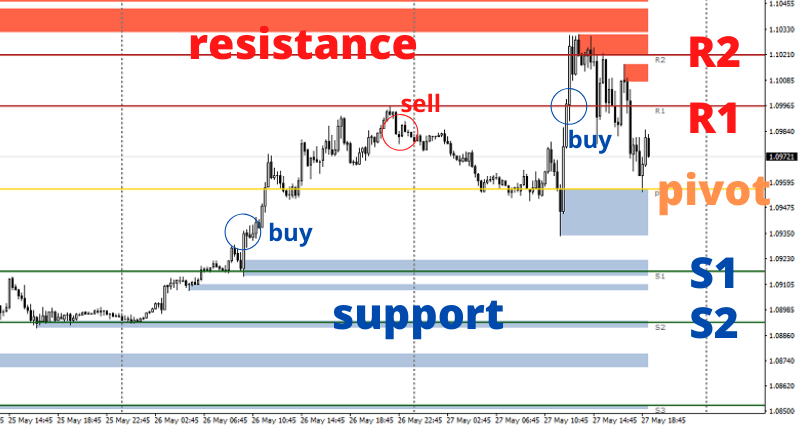

Example of EUR/USD M30 trading using Daily Pivots

The market does not always start above/below the PP and stay in that direction for the rest of the day. If the market breaks through the pivot to the upside, it is a sign that traders are bullish on the pair, and you should start buying. Conversely, if the price breaks through the pivot on the downside, it is a signal that traders are bearish on the pair and that sellers could have the upper hand for the trading session.

In the chart above, the EUR/USD started the day below the PP level, which signalled a short bias for the day. Traders started out shorting the pair without waiting for a test of the PP and they shorted it till it was stopped at the S2. Support level S2 was retested once more, and when it held firm, the market drove the price up to the pivot level.

Around the pivot point, there was a struggle between bears and bulls. Eventually, the bulls gained control over the pivot point with an impressive breakout that drove the market straight up to the R1 level. Again, a long battle was staged at the R1 level, which was eventually knocked out as the bulls drove the market up to R2. Notice how the bears made a nice counterattack at the R2 level, violently pushing down the market to retest the PP level.

However, as the day was ultimately in favour of the bulls as they had successfully broken PP earlier in the day, the bears gave up their counterattack at PP, and the bulls were given another chance to get on board for a nice bounce up at PP.

Pivot point break trading strategy rules:

| Entry & Exit Rules | Long | Short |

|---|---|---|

| Entry Rule | If the price is below PP and breaks up through PP, buy at the market or stop x pips above the PP Level. Alternatively, if you have missed the break, you can buy the retest of the break at PP level. If the break happens too fast and there is no retest, you can take up a long position at R1, so long as momentum is strong and it looks as if it is going to break as well. | If the price is above PP and breaks down through PP, sell at the market or stop entry x pips below PP level. Alternatively, if you have missed the break, you can sell the retest of the break at PP level. If the break happens too fast and there is no retest, you can take up a short position at S1, so long as momentum is strong and it looks as if it is going to break as well. |

| Stop-Loss Rule | SL fixed pips below PP or a few pips below the S1 level for more trade leeway | SL fixed pips above PP or a few pips above the R1 level for more trade leeway |

| Take Profit Rule | TP at R2. If the price reaches R1, set your SL to PP level to minimize risk. | TP at S2. If the price reaches S1, set your SL to PP level to minimize risk. |

Risks of the pivot point break trading strategy

All attempts to trade in the direction of a pivot break have the inherent risk that the pivot will hold firm. You don’t know whether or not the initial move through the pivot will continue. You might enter thinking the price has penetrated successfully, only to be lured into a trap as the bouncers engulf your position and push you back to your stop.

A breakout that looks as if it had happened but did not continue onwards in the direction of the break is called a false break. What is false is not the break that occurred, but your conclusion about its trajectory. You have to be able to quickly read the price action, the candlesticks that are forming at the moment of the break and soon afterwards to understand how the break is materializing.

You also want to make sure that your breakout is a true technical one and not caused by a wild move by an important news release. Spikes in volatility are common during new events and it can mislead traders. So, be aware of what’s on the forex calendar for the day in question.

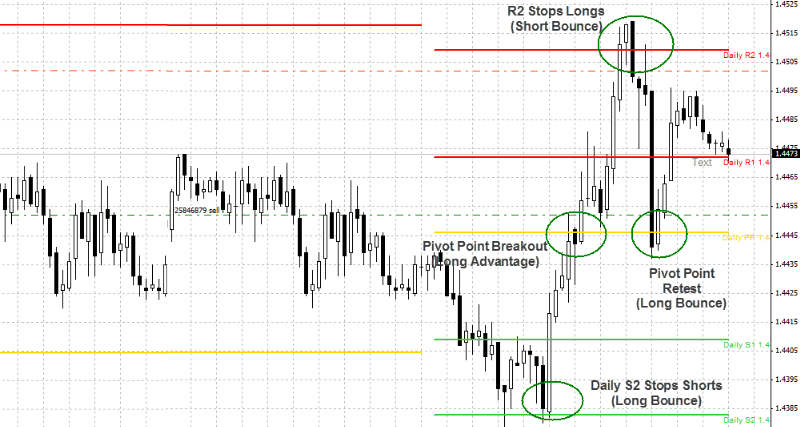

We have seen how pivot lines use a formula derived from yesterday’s high, low, and close bar to determine the pivot and the three levels of support and resistance for the next trading session. The advantages of using them are that they are more objective than the impressionistic support and resistance lines formed drawn across swing lows and highs.

Pivot points are very popular, often so popular that these lines become self-fulfilling, becoming predictive of where the price will stop and reverse or struggle against. Pivot lines are like a battle map for past and future price action.

Once you insert the appropriate pivot lines indicator onto your chart, you can see all the historic battles sites of the market and you can foresee where future battles in the market will be waged. Armed with this knowledge you can then profitably construct your strategies.

The pivot point itself is the centre of the action, and the side that holds the pivot has the upper hand of the day until the pivot is overtaken. To effectively trade the pivot point break strategy, you should be focused on the formation of the first couple of candlesticks that test the line, to see which party is winning, observing if the bars are dominant for bulls or bears and how much shadows they leave behind. If you would like to learn other pivot point trading strategies, visit our forex academy page Pivot Points Trading Strategy.

And there you have it, 3 professional forex trading strategies that work, tried and tested. These forex trading strategies are used by thousands of traders all over the world, especially by expert traders. So, if you are looking for a good forex strategy, make sure to choose one that fits not only your trading style but also one that follows the market trend.