Automated Forex Trading Systems

Data is continually updated by our staff and systems.

Last updated: 28 Jan 2021

We earn commissions from some affiliate partners at no extra cost to users (partners are listed on our ‘About Us’ page in the ‘Partners’ section). Despite these affiliations, our content remains unbiased and independent. We generate revenue through banner advertising and affiliate partnerships, which do not influence our impartial reviews or content integrity. Our editorial and marketing teams operate independently, ensuring the accuracy and objectivity of our financial insights.

Read more about us ⇾

Automated Forex trading systems with a set of rules are used by traders to manage their accounts and their trading activities. They are a good choice for inexperienced traders or for those without time to follow the price action on a chart hour by hour.

Table of Contents

- Automating Forex trading can take control over human trading emotions

- Multiple algorithms allow for trading more markets simultaneously

- Automated trading programs have faster order execution speeds with no delays

- A robust automated system covers most account risk management issues

Why Trading With an Automated System?

This is probably one of the questions that FX traders need a reasonable answer. There are hundreds of other investments out there that you might prefer, but why trade on foreign currencies instead? Forex trading is unique in various aspects:

- Its negotiation volume is relatively huge compared to other markets.

- It has extreme liquidity and the ability to fill any buy or sell order of any currency pair without causing significant market price movements.

- It has the greatest number, and the widest variety of traders.

- Forex is a market with long trading hours, 24 hours a day, with the exception of weekends.

- Trading hubs are almost everywhere, not only in the United States or in major European cities.

- Exchange rates move every hour affected by several factors.

Another fact that will make you enthusiastic about trading Forex is its liquidity and astonishing trading volumes. In fact, it has an average turnover of approximately 5 trillion USD per day, according to the central bank survey triennial of the bis (bank for international regulations).

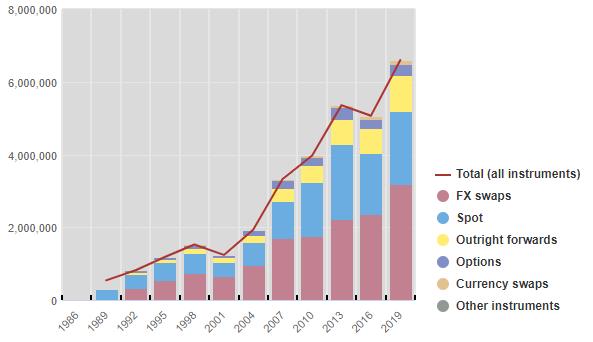

Here are the daily averages, in millions/billions of US dollars, of turnover in the foreign exchange market for the past 30 years, from the BIS (Bank of International Settlements) Triennial Central Bank Survey of Foreign Exchange and Over-the-counter (OTC) Derivatives Markets.

| YEAR | VOLUME IN US$ |

|---|---|

| April 1989 | $ 539 million |

| April 1992 | $ 817 million |

| April 1995 | $ 1.181 billion |

| April 1998 | $ 1.526 billion |

| April 2001 | $ 1.239 billion |

| April 2004 | $ 1.934 billion |

| April 2007 | $ 3.324 billion |

| April 2010 | $ 3.972 billion |

| April 2013 | $ 5.356 billion |

| April 2016 | $ 5.066 billion |

| April 2019 | $ 6.959 billion |

From the figures above, you will notice that the average trend of Forex turnover increases over time. It is estimated to reach $10 billion average daily turnover over the next 2 to 5 years, if the number of traders around the world will continue to increase.

In fact, everyone has the chance to get a substantial slice of the Forex market trading activities, especially now that there are several reliable automated Forex trading systems that can trade the market in auto-mode and turn a profit.

The automation concept becomes the new trend in the currency exchange market, as it trades according to set parameters, cancelling human emotions, often a problem when trading any market. Actually, most of the institutional Forex trading is already done by complex algorithms and software, and high-frequency trading.

Benefits of Using an Automated Forex Trading System

There are several benefits that a Forex retail trader can reap from the automated trading. To compare some of these benefits in relation to manual trading and determine why many investors, such as retail and institutional, prefer the automated process, we will list the main advantages.

Control Over Human Emotions

Develop a manual trading system goes above and beyond the fact of just adding a few technical indicators to a chart and wait for an entry signal to open a buy or sell order.

A perfect manual trading system must also include good money management rules to prevent big losses and to protect the account deposit and the winnings.

But as human nature is not faultless, often traders might even start off with the right foot and start making a few decent trades and profit, just to be caught not following the rules of the manual system and disaster happens.

It’s easy not to admit that we are wrong, after all we are all human, that the market will reverse and our loss will become a profit, soon. It’s easy to fall prey to over trading and opening more losing orders, stacking up and contributing for an even bigger loss. And when the account gets blown up, trauma follows up. Who to blame? The market? The broker? No, just the human emotions.

With an automated trading program, this problem is mostly reduced. The algorithm will only open an order when all the set parameters are inline, but above all, the automated trading program will not let a losing trade snowball into an account blow up.

As automated systems do not follow emotions but set rules, it becomes more infallible regarding a manual system, and therefore it could be a solid alternative for nervous traders.

Order Execution Speed

Thanks to an automated process, transactions can now be performed in real time. Although manual systems have existed for some time, it is difficult to obtain such advantages that the Forex automated system can offer its traders.

Following a set of trading rules, all trades can occur within a few milliseconds and can be a great advantage for automated transactions against the manual system.

In fact, there are problems that a manual trading system has by default, commonly the simple fact, that manual traders do not know, or do not admit, that a losing trader should be closed before it spirals out of control.

With an automated trading, especially if the trader lost a few times in a row, losing confidence on his strategy and preventing him from making new trades, this problem could be minimised using an automatic trading system, with set stop-loss and take-profit levels.

More Markets Available to Trade

With a Forex automated trading, traders will have greater diversification. It is impossibly human to follow hundreds of markets simultaneously. With an automated system, trades can be placed in various instruments and markets in different time zones at any time during Forex market hours.

An automated system can place market orders in any currency pair in other Forex sessions while you are asleep. This advantage allows for traders to set a trading strategy according to the session characteristics.

For example, if a trader in New York wants to take advantage of the upcoming news in the Eurozone, scheduled to be released at 10 am GMT (5 am EST, therefore the New York trader is still sleeping), can use an automated trading system to open an order at a set price and set all the parameters to follow through.

Minimising Risk Management Issues

Risk management issues are minimised through automated Forex trading. Most traders do not know or practise the best money management policies regarding funds safety. It could be over leverage, inadequate trading lot size, high margin risk, etc.

An automated trading software can be set following the best money management rules. As most professional players recommend, traders should only risk 2% of their available margin per trade, and always with an adequate stop-loss level to prevent a huge loss, sometimes a loss bigger than the total account value.

Most automated trading software offer these settings by default, and allowing traders to take advantages of some other features. Traders can “train” the software to trade according to a set maximum drawdown percentage, to only open trades with lot sizes according to a set margin risk percentage and even to apply a compounding strategy (the use of the profits of the winning trades to open bigger positions).

Conclusion

Manual trading systems are great for professional and disciplined Forex traders, or for those with nerves of steal following religiously their manual trading system set rules, regarding entering the markets, but above all that follow their own money management rules.

On the other hand, automated systems are also very popular with institutional traders, banks and investment firms, that more and more are using high-frequency trading systems for their trading activities.

To sum up, automated trading systems are a great choice for those that don’t have the time to follow the price action hour by hour, or don’t feel confident on their trading skills, just yet.

There are several automated systems out there, some are completely free, some come with a commercial licence. If you want to jump into Forex automated trading first prepare a sheet with all the possible parameters that you need to apply to your trading account, especially, deposit amount, leverage ratio and risk percentage.

Then it just a matter of shopping for an automated system that can incorporate those parameters and use it with your favourite broker and trading platform.