Can You Make Money Trading with a Forex Expert Advisor (EA)?

Data is continually updated by our staff and systems.

Last updated: 13 Sep 2021

We earn commissions from some affiliate partners at no extra cost to users (partners are listed on our ‘About Us’ page in the ‘Partners’ section). Despite these affiliations, our content remains unbiased and independent. We generate revenue through banner advertising and affiliate partnerships, which do not influence our impartial reviews or content integrity. Our editorial and marketing teams operate independently, ensuring the accuracy and objectivity of our financial insights.

Read more about us ⇾

Forex Expert Advisors, or EAs, or Forex robots, are trading programs following execution rules allowing traders to take positions in the currency markets automatically.

Forex EAs are used by thousands of traders daily and globally, in the hope of finding the "Holy Grail" winning trading combination and becoming rich, a dream for many, practically for everyone, but still, nothing more than a dream.

In fact, imagine how simple it would be to eradicate world poverty by having retail investors buying a US$20 Forex robot, depositing US$1,000 with a FX broker, attach the robot to the trading platform, let it trade in auto mode, becoming rich in one year, or even two, and then live the life of a philanthropist.

If only it was that simple.

Table of Contents

The human dream that a Forex robot is able to do constant and systematic winning trades for us is still science fiction, a dream far from reality. Of course, there are countless software, scripts and programs that can give traders the edge in Forex trading operations, but we are still very far from being able to entrust all operations to trading robots.

In this article we will see what is the reality with the Forex Expert Advisors currently available on the market, learning also to recognize the obvious trading scams and especially how to avoid the pitfalls generally typical of beginners thirsty for success.

We will analyse what traders can do with this type of artificial intelligence, as well as we will describe the offers generally related to the MetaTrader platform.

What are Forex Expert Advisors and How They Work?

If you have been offered a Forex Expert Advisor that is always able to make positive trades, in principle, you are being cheated. But this does not necessarily mean that trading software cannot help you. A Forex Expert Advisor is a program that can read market data and open and close positions independently. A software that, at its highest level of independence, is able to do Forex trading for us, make technical analysis and decide how much and where to invest.

It is immediately worth to clarify the misconception and the ingrained beliefs that traders can find a Forex EA able to trade autonomously and make systematic profits, to resume, is absolutely impossible.

On the other hand, it is true that institutional Forex trading is highly automated, but it is also true that investment banks, central banks and other such entities still hire very expensive professional traders for the bulk of their operations.

This should give us a measure of the fact that despite billions of dollars of investment in research and development, we are still a long way from seeing computer trading programs taking over the markets. Still, concerning the small retail investor, it is possible to use or partially use programs and systems that can help and automate, at least in part, the Forex trading operations.

Therefore, we will look at the different types of Forex robots that are currently available to retail investors and that can be easily integrated with a trading account.

What are MetaTrader Expert Advisors

MetaTrader Expert Advisors are scripts that can perform different functions, from the most basic analysis with the aid of technical indicators, up to real automatic trading that almost always follow the rules set by its user.

Expert Advisors are available exclusively on MetaTrader trading platforms (MT4 and MT5) and therefore on Forex brokers that offer these specific platforms.

Fraudulent MetaTrader EA Systems Promising Huge Earnings with Automatic Trading

We must point out that among the thousands of Forex EA robots available for MetaTrader, there’s the real possibility that many offered systems, promising earnings based on secret algorithms and trading parameters, which you will surely have come across on the internet, are not going to work.

Watch out particularly to claims of huge earnings, because the systems that are based on promises that are too good to be true, are systems that cannot in any way do or maintain, precisely, what they promise. On the contrary, in most cases they are scams organized by criminal individuals whose only goal is to put their hands in your pocket and run away with the loot.

Where to Buy a Forex Robot for MetaTrader?

There are a lot of Forex EAs available for sale, and let’s make things clear, we are not prejudicially against this practice, but we must necessarily point out what are the characteristics of robots that are worthy your money and especially what kind of capital you should consider to use for this automated trading software.

The MQL market, home of the MetaTrader platforms, is perhaps the best place to buy a MetaTrader Forex EA, a custom-coded script that can, for the most part, conduct operations on its own. Here too, however, there is a need to make some distinctions, because not all auto trading systems are equally valid and to expect an investment that is able to return constant 100% profitable trades on its own is simply absurd.

The only way traders, looking for a Forex robot, have to evaluate the strength and reliability of the scripts and Forex EAs systems that are published and for sale on this platform, are the reviews and analysis of the coders themselves and users. Is it worth trusting the reviews? Not always.

But by using a MetaTrader 4 or MetaTrader 5 demo account with a reputable broker that doesn’t manipulate the prices on demo accounts, and the mimic the same of a real account, traders have the chance to test these scripts and Forex robots without taking any risks.

Regarding Forex robots and other EAs sold online, even when the website selling those items appearance might seem reliable, even when the people behind it might appear to be real experts, in reality, you might be dealing with a potentially very dangerous system, especially if the website selling such products makes claims of huge profits and sells it for 20 dollars.

If a Forex robot could really turn retail investors, particularly the one’s without any trading experience, into millionaires, let’s assume for a moment 100% guaranteed, how much would you be willing to pay? Just 20 dollars?

Just think for a moment. Why on earth would someone sell a product claiming a good winning rate, and promising to turn you into a millionaire for so little money? We’re not talking just about the 20 dollars robots, even the 500 - or 1,000 - dollars Forex robots.

Is Buying a Forex Robot Worth It?

The Forex market is one of the most volatile and unpredictable financial markets to trade and be successful for retail investors, and in this market the analysis capabilities of Forex robots are still far below those of humans.

Not to mention the fact that traders would end up losing not only the money invested on the trading account, but also the money used to buy the robot. To sum up, there is no easy money and buying a Forex robot in the hope of making a breakthrough on the FX market is and will always be, extremely risky.

Forex robots cannot offer traders easy money, the working ones are not coded for this, they were created and coded to help traders in operations. There are situations where a software can work better than a human, like closing all pending orders on one currency pair or completely close all pending orders on the trading account.

They can also be useful for repetitive tasks, or the ones that requiring a quick action, like setting up an automatic stop/loss and take/profit levels for newly opened positions (that could be, actually, very useful for news traders).

But in no case they will be able to successfully trade in your place, in no way they will be able to guarantee trader’s gains nor to behave as human. If this were the case, the major investment banks would not hire top dollar traders and analysts who cost them millions of dollars every year.

And if the best investment banks are not yet able to replace humans with advanced auto trading software, why should you trust someone selling a Forex robot promising hindsight trading and huge returns and sold for 50 dollars?

Copy Trading vs Forex Robots

Copy trading enables retail investors in the financial markets to automatically copy to their trading account the open and managed positions by another selected trader. Copy trading could be and remains one of the valid alternatives to automated trading and Forex robots.

Although we admit that we are still far away from reliable automatic trading as possible, behind copy trading platforms there are flesh and blood, experienced traders trading as humans, and not robots, that retail investors can replicate with a single click.

Plus, there are several safety mechanisms to ensure that the trades are real. For example, and going back to the MQL platform, we can find several manual trading systems available to copy trading, connected to real traders, trading on MetaTrader 4 or MetaTrader 5.

After selecting one that is attractive enough in terms of ROI, potential retail investors can check its performance, the trading account size, the open and closed positions. To become a seller of a trading system on the MQL website, and make it available for copy trading, the trader needs to have its real trading account verified (demo accounts are not allowed).

MQL cleverly pull all the data from the MT4/MT5 trading platforms, whichever the trader uses, and with its calculation algorithms assigns a risk ratio, reliability score and all other visual info that can help traders to decide if that system is the right one to use for copy trading.

Getting a Free Copy Trading Service

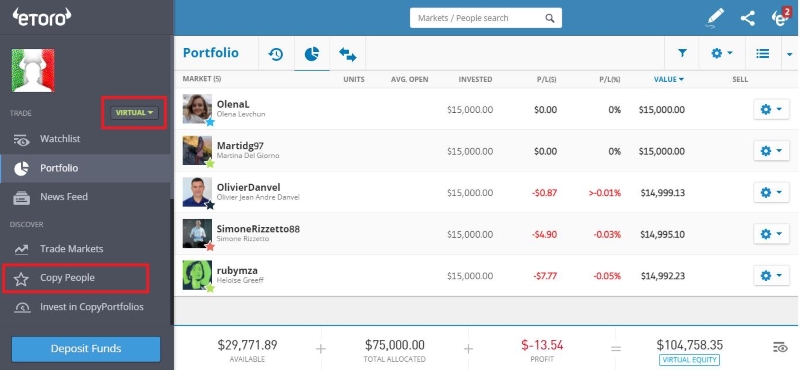

A totally legit way of getting a free copy trading service is to sign up for a free demo account with the, currently, biggest social trading platform, eToro. This broker offers the copy trading system for real trading account holders, but also for demo accounts, free of charge, on any type of asset, from currency trading, to stocks, indices and cryptocurrencies.

Being mainly a social trading platform, it’s quite easy to find on eToro’s “Copy People” tab several traders (professional or not) to copy their trades, in several asset categories. Traders can be selected by geographic location, type of market they invest, the ROI percentage and time they’ve been trading.

Browse the different traders, and when you find one suitable to your risk appetite (in demo account with virtual funds there’s 0 risk), select to “Copy”. That trader’s portfolio will be added to your portfolio, real or virtual, and then you can see what trades they have currently open, with SL and TP levels, and more importantly, when they open new trades, that can be easily copied to other trading platforms, like MetaTrader or cTrader.

The important advantage of copy trading is for those who want to invest by following the trades of more experienced traders, by getting the human trading component and not from a machine.

Final Consideration About Forex Robots

Our final stance and opinion on Forex robots are that they are only good to make money for the people selling them and for those preying on innocent people’s ambitions.

Forex robots or EAs currently are only good to automate tasks that don’t require any risk, like setting pending orders or stop levels. Forex robots are still very limited in any context, and for such a liquid, decentralized market, with a daily turnover of billions of dollars, run by big institutional players, it is impossible that a Forex robot could be programmed and master such complex market.

Whether they are free or paid Forex robots, the fact remains that you should not expect, at least in this lifetime, much from software creators claiming to have the perfect automated Forex robot that can do the trading for you, especially, make you a rich person.

Whoever proposes these ideas and lives off selling them to innocent or desperate traders, must be considered a scammer, period.