低スプレッド外国為替ブローカー | Lowest Spread Forex Brokers

| ブローカー | レビューを投稿する | フォーラム投稿 | 規制 | ユーザー レーティング | 価格のレーティング | 最低入金額 | 最大リバレージ | 資金調達方法 | トレードプラットフォーム | セントアカウント | スキャルピング可 | 実行モデル | 資産の区分 | cc0df488-2ea7-4a93-94e8-ada750cf8a4e | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| レビューを投稿する | 0 |

モーリシャス - MU FSC |

4.4

良い

|

5.0

優秀

|

200 | 500 |

銀行送金

業者と業者

クレジット・デビッドカード

Neteller(ネッテラー)

PayPal(ペイパル)

|

MT4

MT5

cTrader

WebTrader

|

ECN

ECN/STP

STP

|

361653a7-809e-4f9c-9f9c-d7b836d847d3 | https://www.ictrading.com?camp=74653 | |||||

| レビューを投稿する | 0 |

オーストラリア - AU ASIC モーリシャス - MU FSC 南アフリカ - ZA FSCA セイシェル - SC FSA |

4.2

良い

|

20 | 1000 |

銀行送金

クレジット・デビッドカード

E-wallets

|

MT4

MT5

Proprietary

|

|

125c1b1d-f20a-43b1-99d3-1c577329eee2 | https://www.puprime.com/ | ||||||

| レビューを投稿する | 0 |

4.5

優秀

|

4.5

優秀

|

0 | 2000 |

MT4

MT5

Proprietary

|

ECN

|

ab58087c-599f-4da9-a883-e70432cc0d25 | https://www.tradetaurex.com/?utm_campaign=12370133-CBFX-Taurex-Review&utm_source=CBFX-Website&utm_medium=Visit-Taurex-CTA | |||||||

| レビューを投稿する | 0 |

キプロス - CY CYSEC モーリシャス - MU FSC 南アフリカ - ZA FSCA セイシェル - SC FSA |

4.2

良い

|

10 | 3000 |

MT4

MT5

|

|

外国為替

株式

指標

石油 / エネルギー

仮想通貨

メタル

|

087a7d60-9c22-4b3d-928c-f032691b6721 | https://justmarkets.com/?utm_source=cashbackforex&utm_medium=pr&utm_campaign=review | ||||||

| レビューを投稿する | 0 |

モーリシャス - MU FSC |

評価なし

|

0 | 1000 |

チャイナユニオンペイ

クレジット・デビッドカード

E-wallets

Crypto wallets

Apple Pay

Googlepay

|

MT4

MT5

WebTrader

|

|

1eafe537-7fab-4b73-b9dd-39786471ba21 | https://fintrixmarkets.com/ | ||||||

| レビューを投稿する | 0 |

コモロ - KM MISA |

4.6

優秀

|

10 | 1000 |

cTrader

MT5

|

ECN

STP

|

外国為替

株式

指標

絆

仮想通貨

|

86ba3e76-773e-4f7a-ab50-644c6993c0ba | https://zforex.com/?contractNo=13140300 | ||||||

| レビューを投稿する | 0 |

モーリシャス - MU FSC バヌアツ - VU VFSC セイシェル - SC FSA イギリス領ヴァージン諸島 - BVI FSC |

4.5

優秀

|

4.5

優秀

|

0 | 1000 |

銀行送金

クレジット・デビッドカード

Neteller(ネッテラー)

Skrill (マネーブッカーズ)

SticPay

Bitwallet

|

MT4

MT5

WebTrader

|

ECN

STP

|

外国為替

指標

石油 / エネルギー

仮想通貨

メタル

|

caed1ba5-9f5d-4466-ba78-cb2f048ebb38 | https://partners.titanfx.com/registration/ref?cp=7T6NEWQ3YL325 | titanfx.com | |||

| レビューを投稿する | 0 |

オーストラリア - AU ASIC キプロス - CY CYSEC バヌアツ - VU VFSC |

1.0

良くない

|

5 | 1000 |

|

MT4

MT5

WebTrader

|

|

d89a91df-79c8-499c-860f-56f056c04008 | https://vc.cabinet.oneroyal.com/links/go/14476 | ||||||

| レビューを投稿する | 0 |

オーストラリア - AU ASIC キプロス - CY CYSEC セイシェル - SC FSA |

4.8

優秀

|

5.0

優秀

|

200 | 1000 |

MT4

MT5

WebTrader

cTrader

TradingView

|

ECN

ECN/STP

STP

|

aefd1a92-444e-498b-b3cb-304cce7bf43f | https://icmarkets.com/?camp=1516 | ||||||

| レビューを投稿する | 0 |

ケイマン諸島 - KY CIMA イギリス - UK FCA オーストラリア - AU ASIC |

3.3

平均

|

4.6

優秀

|

48 | 500 |

銀行送金

チャイナユニオンペイ

クレジット・デビッドカード

SticPay

Tether (USDT)

|

MT4

|

STP

|

外国為替

指標

石油 / エネルギー

メタル

|

6f8fc816-30a8-4b97-8d14-71ae4f3b327e | https://www.ebc.com/?fm=cashbackforex | ebcfin.co.uk | |||

| レビューを投稿する | 0 |

モーリシャス - MU FSC アラブ首長国連邦 - UAE SCA |

4.5

優秀

|

100 | 500 |

銀行送金

クレジット・デビッドカード

|

MT5

|

|

f0aeb024-3289-4231-886a-39f6f47f0f6a | https://trade247.com/ | ||||||

| レビューを投稿する | 0 |

モーリシャス - MU FSC |

4.5

優秀

|

50 | 500 |

MT5

WebTrader

MT4

|

NDD

|

d5d8209f-d2b3-43f7-9ac0-a1e48c1bb1bd | https://secure.keytomarkets.com/links/go/7250 | |||||||

| レビューを投稿する | 0 |

オーストラリア - AU ASIC |

4.5

優秀

|

50 | 1000 |

MT4

MT5

|

|

04cd66d4-49f2-4ca3-ac09-4fe5951433d0 | https://www.switchmarkets.com/?utm_source=fxverify&utm_medium=referral&utm_campaign=fxverify-referral-listing&utm_term=fxverify-referral-listing&utm_content=listing | switchmarkets.eu | ||||||

| レビューを投稿する | 0 |

オーストラリア - AU ASIC イギリス - UK FCA モーリシャス - MU FSC |

3.3

平均

|

10 | 1000 |

銀行送金

クレジット・デビッドカード

|

MT4

MT5

|

|

外国為替

指標

石油 / エネルギー

仮想通貨

メタル

|

60f5162e-6def-461b-ad20-75088a9d68a5 | https://hmarkets.com | |||||

| レビューを投稿する | 0 |

オーストラリア - AU ASIC キプロス - CY CYSEC イギリス - UK FCA バハマ - BS SCB ケニア - KE CMA |

4.3

良い

|

4.5

優秀

|

200 | 400 |

cTrader

MT4

MT5

TradingView

|

ECN/STP

NDD

|

7fd9da2f-3512-4a19-9ea4-bf9978d7f25b | http://trk.pepperstonepartners.com/aff_c?offer_id=139&aff_id=14328 | pepperstone.com trk.pepperstonepartners.com | |||||

| レビューを投稿する | 0 |

南アフリカ - ZA FSCA セイシェル - SC FSA |

4.6

優秀

|

10 | 1000 |

銀行送金

クレジット・デビッドカード

E-wallets

|

MT5

WebTrader

Proprietary

|

|

外国為替

指標

石油 / エネルギー

仮想通貨

メタル

ソフト コモディティ (コーヒー、砂糖等)

|

f0037994-f6b5-493e-8158-28267cb98df9 | https://go.primexbt.direct/visit/?bta=42303&nci=7153 | |||||

| レビューを投稿する | 0 |

イギリス - UK FCA モーリシャス - MU FSC |

4.5

優秀

|

4.4

良い

|

50 | 2000 |

銀行送金

ビットコイン

チャイナユニオンペイ

クレジットカード

Alipay

Tether (USDT)

|

MT4

WebTrader

Proprietary

|

STP

ECN

|

41e11426-eaf6-4052-833d-eba2a149c602 | https://www.ultimamarkets.com/?affid=NzQ1ODY= | ultimamkts.com | ||||

| レビューを投稿する | 0 |

キプロス - CY CYSEC イギリス - UK FCA 南アフリカ - ZA FSCA アラブ首長国連邦 - AE DFSA セイシェル - SC FSA ケニア - KE CMA |

4.1

良い

|

4.5

優秀

|

0 | 2000 |

MT4

MT5

WebTrader

Proprietary

|

MM

|

5a10711e-83ea-45d4-9f49-5778cc6aba18 | http://hotforex.com/?refid=8180 | ||||||

| レビューを投稿する | 0 |

オーストラリア - AU ASIC キプロス - CY CYSEC |

4.6

優秀

|

30 | 2000 |

銀行送金

クレジット・デビッドカード

Neteller(ネッテラー)

Skrill (マネーブッカーズ)

Crypto wallets

|

MT4

MT5

|

|

外国為替

株式

指標

石油 / エネルギー

仮想通貨

メタル

|

fb7bc7ef-28cd-4543-9a9b-a8d35c997dd8 | https://www.fisg.com/en/landing/universal?link_id=Ff38st6Rn&referrer_id=fZUFRCvgM | interstellarfx.eu | ||||

| レビューを投稿する | 0 |

バヌアツ - VU VFSC |

4.5

優秀

|

4.3

良い

|

10 | 3000 |

銀行送金

ビットコイン

クレジット・デビッドカード

SticPay

Bitwallet

Tether (USDT)

|

MT4

MT5

|

|

外国為替

株式

指標

石油 / エネルギー

仮想通貨

メタル

|

2a8ee473-9319-430f-8759-388609a3588b | https://jmarkets.com/ | ||||

| レビューを投稿する | 0 |

オーストラリア - AU ASIC イギリス - UK FCA ケイマン諸島 - KY CIMA バヌアツ - VU VFSC |

4.6

優秀

|

5.0

優秀

|

200 | 500 |

MT4

MT5

WebTrader

|

ECN

|

e0a6e43b-cf35-4dde-9fc2-90d09eb31441 | https://www.vantagemarkets.com/?affid=58535 | partners.vantagemarkets.com | |||||

| レビューを投稿する | 0 |

オーストラリア - AU ASIC キプロス - CY CYSEC イギリス - UK FCA セイシェル - SC FSA ヨルダン - JO JSC |

4.5

優秀

|

5.0

優秀

|

100 | 1000 |

MT4

WebTrader

MT5

|

MM

|

0cfff50d-8142-4b7c-9e92-3d2e1ee7299b | https://admiralmarkets.onelink.me/7Buw/u9tvsp79 | admiralmarkets.com admirals.com partners.admiralmarkets.com | |||||

| レビューを投稿する | 0 |

クック諸島 - CK FSC コモロ - KM MISA |

4.5

優秀

|

5.0

優秀

|

100 | 3000 |

クレジット・デビッドカード

パーフェクトマネー

Crypto wallets

|

MT4

MT5

WebTrader

|

NDD/STP

ECN/STP

NDD

MM

|

1c116594-d4ab-4898-87be-46c3099edd9b | https://amarkets.com | amarkets.com amarkets.org main.amarkets.life | ||||

| レビューを投稿する | 0 |

オーストラリア - AU ASIC イギリス - UK FCA アラブ首長国連邦 - AE DFSA |

4.6

優秀

|

5.0

優秀

|

0 | 500 |

MT4

WebTrader

|

STP

|

e21c5f46-ba10-486b-b3a8-c5487a7e4abc | https://www.axitrader.com/uk?promocode=470470 | axi.com | |||||

| レビューを投稿する | 0 |

オーストラリア - AU ASIC キプロス - CY CYSEC イギリス - UK FCA |

4.0

良い

|

5.0

優秀

|

100 | 500 |

MT4

MT5

WebTrader

|

ECN/STP

|

de3b0e43-0b07-4d19-b30d-a69c69ce0275 | https://www.fxopen.com/ | ||||||

| レビューを投稿する | 0 |

ベリーズ - BZ FSC |

4.5

優秀

|

5.0

優秀

|

10 | 2000 |

MT4

MT5

WebTrader

Proprietary

|

ECN

MM

STP

|

外国為替

株式

指標

石油 / エネルギー

メタル

ETFs

|

b4bb5887-39a0-436d-8711-30a8cdb29637 | http://www.roboforex.com/?a=fvsr | |||||

| レビューを投稿する | 0 |

オーストラリア - AU ASIC キプロス - CY CYSEC イギリス - UK FCA 日本 - JP FSA 南アフリカ - ZA FSCA セイシェル - SC FSA |

3.5

良い

|

5.0

優秀

|

0 | 2000 |

MT4

MT5

Proprietary

|

MM

NDD

|

25a2f5c3-b306-4cab-ad45-71c5216cc79f | https://welcome-partners.thinkmarkets.com/afs/come.php?atype=1&cid=4926&ctgid=1001&id=4944 | thinkmarkets.com | |||||

| レビューを投稿する | 0 |

キプロス - CY CYSEC イギリス - UK FCA 南アフリカ - ZA FSCA アラブ首長国連邦 - AE DFSA セイシェル - SC FSA |

4.8

優秀

|

5.0

優秀

|

100 | 1000 |

MT4

MT5

WebTrader

|

NDD

STP

STP DMA

|

964c8d39-4737-4dd2-ad77-737d8a814dff | https://tickmill.com?utm_campaign=ib_link&utm_content=IB42043247&utm_medium=Tickmill&utm_source=link&lp=https%3A%2F%2Ftickmill.com%2F | tickmill.com/eu tickmill.com/uk | |||||

| レビューを投稿する | 0 |

マルタ - MT MFSA ケイマン諸島 - KY CIMA マレーシア - LB FSA |

4.5

優秀

|

5.0

優秀

|

0 | 400 |

MT5

Proprietary

cTrader

MT4

WebTrader

|

ECN/STP

|

8af74d9b-18ff-4a58-bac4-df79f859d28f | https://www.tradeviewforex.com/?ib=1263 | ||||||

| レビューを投稿する | 0 |

キプロス - CY CYSEC イギリス - UK FCA ベリーズ - BZ FSC |

4.1

良い

|

5.0

優秀

|

1 | 0 |

銀行送金

クレジット・デビッドカード

PayPal(ペイパル)

PaySafeCard(ペイセーフカード)

Skrill (マネーブッカーズ)

|

MT4

|

|

1fcea348-c8ba-4a3b-84b2-92314f3047ad | https://xtb.com | |||||

| レビューを投稿する | 0 |

キプロス - CY CYSEC 南アフリカ - ZA FSCA |

4.3

良い

|

4.9

優秀

|

50 | 500 |

MT4

MT5

Proprietary

|

ECN

NDD

|

外国為替

株式

指標

石油 / エネルギー

仮想通貨

メタル

|

aad7db3c-01d8-4653-82ac-baeed5f69c31 | https://global.fxview.com/register?refLink=NDg3&refRm=ODg%3D&utm_source=cbf_fxv&utm_medium=cbf_cta&utm_campaign=fxv_cbf_rvw&utm_id=911&utm_content=Fxview | fxview.com | ||||

| レビューを投稿する | 0 |

オーストラリア - AU ASIC キプロス - CY CYSEC イギリス - UK FCA バハマ - BS SCB |

4.5

優秀

|

4.8

優秀

|

100 | 500 |

MT4

MT5

WebTrader

TradingView

|

MM

|

外国為替

株式

指標

石油 / エネルギー

仮想通貨

メタル

|

c945998d-a18c-4333-9c89-c5ffbe9c8569 | https://join.eightcap.com/visit/?bta=36849&nci=5523 | |||||

| レビューを投稿する | 0 |

モーリシャス - MU FSC 南アフリカ - ZA FSCA セイシェル - SC FSA イギリス領ヴァージン諸島 - BVI FSC ケニア - KE CMA Curacao - CW CBCS |

4.4

良い

|

4.8

優秀

|

1 | 0 |

MT4

MT5

WebTrader

|

MM

|

外国為替

株式

指標

石油 / エネルギー

仮想通貨

メタル

|

d19e2bb1-a923-40e3-bbea-b4c418ffbd81 | https://one.exness.link/a/uku889th | one.exness.link exness.com | ||||

| レビューを投稿する | 0 |

オーストラリア - AU ASIC キプロス - CY CYSEC モーリシャス - MU FSC 南アフリカ - ZA FSCA セイシェル - SC FSA |

4.4

良い

|

4.8

優秀

|

100 | 500 |

cTrader

MT4

MT5

WebTrader

|

ECN/STP

|

8255eba0-8015-4001-8318-f2f24c0965e6 | https://fpmarkets.com/?fpm-affiliate-utm-source=IB&fpm-affiliate-pcode=14908&fpm-affiliate-agt=14908 | www.fpmarkets.eu www.fpmarkets.com/int | |||||

| レビューを投稿する | 0 |

セイシェル - SC FSA |

4.5

優秀

|

4.7

優秀

|

10 | 1000 |

アストロペイ

銀行送金

クレジット・デビッドカード

パーフェクトマネー

ZotaPay

|

MT5

Proprietary

|

STP

|

517956ff-4dd3-4257-93ff-f9cfd251e90d | https://fxcentrum.com/homepageref/ | fxcentrum.com | ||||

| レビューを投稿する | 0 |

オーストラリア - AU ASIC バヌアツ - VU VFSC |

4.3

良い

|

4.7

優秀

|

0 | 500 |

MT4

|

STP

ECN

|

外国為替

株式

指標

絆

石油 / エネルギー

メタル

|

b2ef5b0c-829f-45ba-a68b-76dbc7b4e568 | https://globalprime.com/?refcode=82302 | |||||

| レビューを投稿する | 0 |

キプロス - CY CYSEC セイシェル - SC FSA |

4.5

優秀

|

4.7

優秀

|

100 | 500 |

銀行送金

クレジット・デビッドカード

Neteller(ネッテラー)

Skrill (マネーブッカーズ)

Revolut

Wise

|

cTrader

MT4

MT5

|

ECN/STP

|

a1e0ad69-6636-42c7-a546-13e32012df2c | https://oqtima.com/?r_code=IB0318050056A&expiry_date=Nw== | oqtima.eu oqtima.com | ||||

| レビューを投稿する | 0 |

コモロ - KM MISA |

3.8

良い

|

4.7

優秀

|

0 | 1000 |

MT4

MT5

|

NDD/STP

MM

ECN/STP

ECN

|

外国為替

株式

指標

石油 / エネルギー

仮想通貨

メタル

|

48517584-3421-4fba-ad29-97219e38aa32 | https://go.xchief.com/27c7c1 | xchief.com | ||||

| レビューを投稿する | 0 |

バヌアツ - VU VFSC |

4.5

優秀

|

4.6

優秀

|

25 | 500 |

|

MT4

Allpips

|

ECN/STP

|

外国為替

指標

仮想通貨

メタル

|

789b4f74-a225-497a-b72c-063377c377da | https://adrofx.com?refid=50835fb6-927e-49fe-93ce-4ce9e8d052c7 | ||||

| レビューを投稿する | 0 |

南アフリカ - ZA FSCA バヌアツ - VU VFSC セイシェル - SC FSA キプロス - CY CYSEC |

4.3

良い

|

4.6

優秀

|

5 | 5000 |

銀行送金

クレジット・デビッドカード

SticPay

Bitwallet

|

MT4

MT5

|

MM

|

外国為替

株式

指標

石油 / エネルギー

仮想通貨

メタル

|

ac5a8820-6baf-41ca-b55a-3edf419b5326 | https://fxgt.com/?refid=24240 | ||||

| レビューを投稿する | 0 |

イギリス - UK FCA モーリシャス - MU FSC ケニア - KE CMA |

4.2

良い

|

4.6

優秀

|

500 | 2000 |

MT4

MT5

WebTrader

|

ECN

|

外国為替

株式

指標

石油 / エネルギー

メタル

ソフト コモディティ (コーヒー、砂糖等)

|

35bd320c-ad29-4460-8a55-528a3dfeb5a2 | https://www.forextime.com/?partner_id=4900292 | |||||

| レビューを投稿する | 0 |

南アフリカ - ZA FSCA セイシェル - SC FSA |

2.8

平均

|

4.6

優秀

|

50 | 1000 |

|

MT4

MT5

WebTrader

Proprietary

|

STP

ECN

|

fb776fc4-4a02-420c-b57d-be0f60285fc7 | https://go.monetamarkets.com/visit/?bta=37266&nci=5342 | monetamarkets.com | ||||

| レビューを投稿する | 0 |

オーストラリア - AU ASIC 南アフリカ - ZA FSCA |

3.5

良い

|

4.6

優秀

|

100 | 500 |

MT4

MT5

WebTrader

|

STP

NDD

ECN

|

a6115497-2f75-4fa7-af28-ceed136a6e6f | https://www.vtmarkets.com/?affid=840375 | vtaffiliates.com | |||||

| レビューを投稿する | 0 |

オーストラリア - AU ASIC バヌアツ - VU VFSC |

評価なし

|

4.5

優秀

|

200 | 500 |

MT4

MT5

WebTrader

|

MM

|

f8f29019-932c-409a-8984-a065fc9b9bc0 | https://clients.fxtrading.com/referral?r_code=IB01877918B | ||||||

| レビューを投稿する | 0 |

イギリス - UK FCA バハマ - BS SCB |

4.3

良い

|

4.5

優秀

|

100 | 200 |

MT4

WebTrader

cTrader

MT5

Proprietary

|

NDD

|

c3cb04ca-7a5e-4917-89d5-56cb48e76a74 | https://www.fxpro.jpn.com/ | ||||||

| レビューを投稿する | 0 |

バヌアツ - VU VFSC |

3.2

平均

|

4.5

優秀

|

1 | 1000 |

MT4

MT5

|

|

6eb20fd0-81c3-4abc-8795-85c39522b3dd | https://www.n1cm.com/?partner_id=244132 | ||||||

| レビューを投稿する | 0 |

日本 - JP FSA ギリシャ - EL HCMC |

4.5

優秀

|

4.5

優秀

|

0 | 500 |

|

Proprietary

|

MM

STP

|

外国為替

株式

指標

仮想通貨

|

2a4912be-bd86-41ed-809a-f069add85da3 | http://clearmarkets1.zulutrade.com/ | zulutrade.com zulutradejapan.com | |||

| レビューを投稿する | 0 |

オーストラリア - AU ASIC キプロス - CY CYSEC ベリーズ - BZ FSC |

4.6

優秀

|

4.4

良い

|

5 | 3000 |

MT4

MT5

Proprietary

|

NDD/STP

|

995bc6b9-c826-4856-a1a7-9d25f35b6c81 | https://fbs.partners?ibl=794494&ibp=33121722 | fbs.com | |||||

| レビューを投稿する | 0 |

オーストラリア - AU ASIC キプロス - CY CYSEC モーリシャス - MU FSC セイシェル - SC FSA |

4.5

優秀

|

4.2

良い

|

200 | 500 |

cTrader

MT4

MT5

WebTrader

|

ECN/STP

|

外国為替

株式

指標

石油 / エネルギー

仮想通貨

メタル

|

3bc4e234-6e1c-4b57-a17c-8d6d261e4bec | https://www.gomarkets.com/en/?Pcode=1100048 | gomarkets.eu int.gomarkets.com gomarkets.com/au | ||||

| レビューを投稿する | 0 |

キプロス - CY CYSEC セイシェル - SC FSA |

4.5

優秀

|

4.2

良い

|

50 | 500 |

cTrader

MT4

MT5

|

MM

|

2dd15bc0-e926-4913-81db-b8f95d0ad5e8 | https://myportal.errante.com/links/go/1043 | errante.com | |||||

Lowest Spread Forex Brokers

In forex trading a low spread is crucial, not only to give traders a more favourable entry price, but also important for those employing scalping or hedging strategies. Thus, a 0 pip spread is the perfect spread for both strategies.

But above all, spreads are an important part of the overall trading costs. This means smaller spreads, more profit for traders. To find one of the best lowest spread forex brokers for your strategy, check out our comparison table, sorted by pricing rating.

The pricing rating is how our industry experts rate each broker's spreads and overall cost of trading. This also includes trading commissions, deposit and withdrawal fees, and other charges.

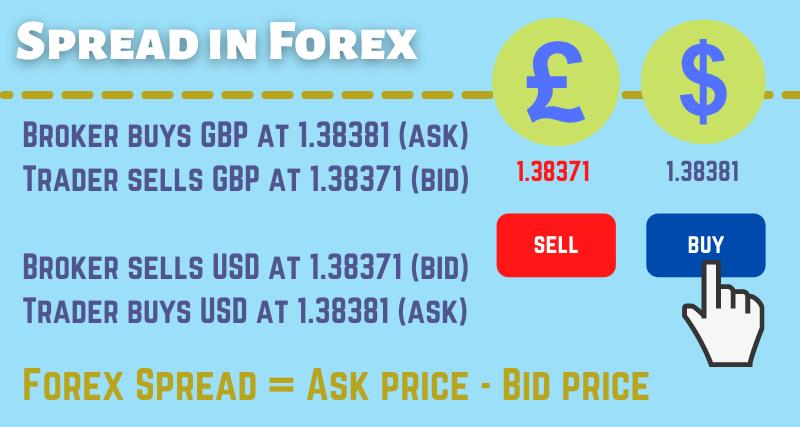

What is the Spread in Forex?

The spread in forex is the difference between the bid and the ask price, for each single currency pair. This value (the spread) is also the profit of the forex brokers, who buy the base currency at bid price (lower) and sell the quote currency at ask price (higher).

A practical example of a forex broker spread for the GBP/USD pair, and from the trader’s perspective, would be:

- Buy price (ask price) 1.38381 vs sell price (bid price) 1.38371 = spread 1 pip.

This means that the broker is willing to buy the base currency (GBP) from the trader at 1.38371 (bid price) in exchange for selling the quote currency (USD) to trader at 1.38381 (ask price).

By selling at a higher price and buying at a lower price, the broker makes a profit on the spread. Because traders always buy at a higher price, and sell at a lower price, this also means that investors will, invariably, start a trade always in loss.

Of course, if the spread would be 0 pip, a trader could open and close a position on the same instant, without a profit, or a loss. But in reality, this is impossible. ECN forex brokers market their spreads "as low as 0 pip", but there's also trading commissions added to the total cost of opening a trade.

- For traders, a currency pair real trading cost is the broker’s spread plus the trading commissions.

These commissions are normally calculated in USD, and they have the equivalent value in pips. For example, 1 pip is 10 USD on a standard forex lot (100,000 currency units).

As we saw above, ECN brokers advertise a 0 pip spread on the EUR/USD pair, but charge a trading commission, usually, 7 USD per 1 round lot. So, a trader opening a buy position of 1 lot at 1.20565 will only reach breakeven if the price goes up to 1.20572 (up by 0.7 pip).

Comparatively, a broker offering a 0.6 pip spread on the EUR/USD pair without commissions, is cheaper to trade with than an ECN broker offering a 0.2 pip spread, but charging a trading commission of 7 USD on the same pair. The total spread with the ECN broker would be 0.9 pip.

Trading commissions in USD can be easily converted in pips (1 pip size is 0.0001), to find out how many pips the price needs to move to reach breakeven (or to know the real spread cost). For that, simply use the following formula:

To find out what would be the brokers’ commissions for different size lots, (assuming a 7 USD commission), simply divide the broker’s commission by 10. Then multiply the currency units of the trading position by the commission in pip size, or, check the table below:

| Lot Size | Currency Units | Commission in Pip | Commission in USD |

|---|---|---|---|

| 0.01 | 1,000 | 0.00007 | 0.07 |

| 0.10 | 10,000 | 0.00007 | 0.70 |

| 1 | 100,000 | 0.00007 | 7 |

| 10 | 1,000,000 | 0.00007 | 70 |

How to Lower Your Broker Spreads

There’s a way, legal by all means, that thousands of traders use to lower even more the broker’s spreads. Even with ECN brokers with a 0 pip spread, and charging trading commissions.

As we saw above, the trading commissions can also be converted in pip size and value. Clever traders are taking advantage of forex rebates programs, like the one offered by our site.

Forex rebates allows traders to reduce their trading costs and spreads. But at the same time, to earn extra cash from trades, regardless if a trade is closed in profit or loss.

Forex rebates are a cashback program offered by a third-party provider, linked to a forex trading account, and paying a cash rebate for each closed trade.

The cash rebate is a portion of the transaction cost, spread or commissions, or a combination of both, that is paid back to the client on each trade. This results in lower spreads, and above all, an improved win ratio for the trader.

- For example, if the rebate from the broker is 0.3 pip for the GBP/USD pair, and the typical spread is 0.8 pip, then the net spread for the trader is only 0.5 pip.

Also, there is no "catch". The broker spreads will never increase as a result of using a rebates service! In the end, trading via a rebates provider will result in lower spreads, period. And of course, it is more beneficial to a trader’s financial position to work via a rebates provider than solely with the forex broker.

To find a complete list of all the brokers, linked to our cashback program and paying rebates, we recommend a quick visit to our Brokers Page. We have several partnerships with brokers paying rebates on forex and cryptocurrencies trades.