Lowest Spread Forex Brokers in 2026 Comparison Table

| Broker | Submit Review | Forum Posts | Regulation | User Rating | Pricing rating | Minimum deposit | Maximum leverage | Funding Methods | Trading platforms | Cent accounts | Scalping allowed | Execution model | Asset classes | a30de830-d8dc-4e6d-a91c-cec87b609e0b | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Submit Review | 0 |

Mauritius - MU FSC |

4.4

Good

|

5.0

Excellent

|

200 | 500 |

Bank Wire

Broker to Broker

Credit/Debit Card

Neteller

PayPal

|

MT4

MT5

cTrader

WebTrader

|

ECN

ECN/STP

STP

|

95c848f6-9efe-4a1c-be97-b64465bff538 | https://www.ictrading.com?camp=74653 | |||||

| Submit Review | 0 |

Mauritius - MU FSC |

No Rating

|

0 | 1000 |

China Union Pay

Credit/Debit Card

E-wallets

Crypto wallets

Apple Pay

Googlepay

|

MT4

MT5

WebTrader

|

|

b0d03a8c-e072-4050-a9f0-f9a2242ccac1 | https://fintrixmarkets.com/ | ||||||

| Submit Review | 0 |

South Africa - ZA FSCA Seychelles - SC FSA |

4.6

Excellent

|

10 | 1000 |

Bank Wire

Credit/Debit Card

E-wallets

|

MT5

WebTrader

Proprietary

|

|

Forex

Indices

Oil/Energies

Cryptocurrencies

Metals

Soft Commodities (coffee, sugar...)

|

cb174003-ecda-40be-a7fd-0a9d8a08a06b | https://go.primexbt.direct/visit/?bta=42303&nci=7153 | |||||

| Submit Review | 0 |

Cayman Islands - KY CIMA United Kingdom - UK FCA Australia - AU ASIC |

3.3

Average

|

4.6

Excellent

|

48 | 500 |

Bank Wire

China Union Pay

Credit/Debit Card

SticPay

Tether (USDT)

|

MT4

|

STP

|

Forex

Indices

Oil/Energies

Metals

|

d09ba0eb-900c-470d-8bf7-ee589a1cfd1c | https://www.ebc.com/?fm=cashbackforex | ebcfin.co.uk | |||

| Submit Review | 0 |

Vanuatu - VU VFSC |

4.5

Excellent

|

4.3

Good

|

10 | 3000 |

Bank Wire

Bitcoin

Credit/Debit Card

SticPay

Bitwallet

Tether (USDT)

|

MT4

MT5

|

|

Forex

Shares

Indices

Oil/Energies

Cryptocurrencies

Metals

|

9b3ee9ad-fe67-4f79-9cc2-9f911cdc4806 | https://jmarkets.com/ | ||||

| Submit Review | 0 |

United Kingdom - UK FCA Mauritius - MU FSC |

4.5

Excellent

|

4.4

Good

|

50 | 2000 |

Bank Wire

Bitcoin

China Union Pay

Credit Card

Alipay

Tether (USDT)

|

MT4

WebTrader

Proprietary

|

STP

ECN

|

4880fc1f-f99f-47e7-b8de-a3d7e6ee8b1b | https://www.ultimamarkets.com/?affid=NzQ1ODY= | ultimamkts.com | ||||

| Submit Review | 0 |

Mauritius - MU FSC United Arab Emirates - UAE SCA |

4.5

Excellent

|

100 | 500 |

Bank Wire

Credit/Debit Card

|

MT5

|

|

626bc0b7-2360-4663-a3f3-d6c29160f38e | https://trade247.com/ | ||||||

| Submit Review | 0 |

Australia - AU ASIC Mauritius - MU FSC South Africa - ZA FSCA Seychelles - SC FSA |

4.2

Good

|

20 | 1000 |

Bank Wire

Credit/Debit Card

E-wallets

|

MT4

MT5

Proprietary

|

|

f855ec17-06db-498c-8939-18b2678eed38 | https://www.puprime.com/ | ||||||

| Submit Review | 0 |

Australia - AU ASIC Cyprus - CY CYSEC United Kingdom - UK FCA Bahamas - BS SCB Kenya - KE CMA |

4.3

Good

|

4.5

Excellent

|

200 | 400 |

cTrader

MT4

MT5

TradingView

|

ECN/STP

NDD

|

7c954774-1e04-452e-8b1a-c7d268d21f43 | http://trk.pepperstonepartners.com/aff_c?offer_id=139&aff_id=14328 | pepperstone.com trk.pepperstonepartners.com | |||||

| Submit Review | 0 |

Mauritius - MU FSC Vanuatu - VU VFSC Seychelles - SC FSA Virgin Islands, British - BVI FSC |

4.5

Excellent

|

4.5

Excellent

|

0 | 1000 |

Bank Wire

Credit/Debit Card

Neteller

Skrill

SticPay

Bitwallet

|

MT4

MT5

WebTrader

|

ECN

STP

|

Forex

Indices

Oil/Energies

Cryptocurrencies

Metals

|

8aa58f96-be4b-486d-b9ee-1d837434a774 | https://partners.titanfx.com/registration/ref?cp=7T6NEWQ3YL325 | titanfx.com | |||

| Submit Review | 0 |

Australia - AU ASIC United Kingdom - UK FCA Mauritius - MU FSC |

3.3

Average

|

10 | 1000 |

Bank Wire

Credit/Debit Card

|

MT4

MT5

|

|

Forex

Indices

Oil/Energies

Cryptocurrencies

Metals

|

18aad205-d8dd-4b9b-b0fa-dc2a4b3e13d1 | https://hmarkets.com | |||||

| Submit Review | 0 |

Cyprus - CY CYSEC United Kingdom - UK FCA South Africa - ZA FSCA United Arab Emirates - AE DFSA Seychelles - SC FSA Kenya - KE CMA |

4.1

Good

|

4.5

Excellent

|

0 | 2000 |

MT4

MT5

WebTrader

Proprietary

|

MM

|

f8345804-e94b-4e97-b0af-f9ae921dad05 | https://www.hfm.com/sv/en/?refid=13943 | ||||||

| Submit Review | 0 |

Australia - AU ASIC United Kingdom - UK FCA Cayman Islands - KY CIMA Vanuatu - VU VFSC |

4.6

Excellent

|

5.0

Excellent

|

200 | 500 |

MT4

MT5

WebTrader

|

ECN

|

8a47bf85-6eb2-481d-b53c-be23be8607c9 | https://www.vantagemarkets.com/?affid=58535 | partners.vantagemarkets.com | |||||

| Submit Review | 0 |

Australia - AU ASIC Cyprus - CY CYSEC Seychelles - SC FSA |

4.8

Excellent

|

5.0

Excellent

|

200 | 1000 |

MT4

MT5

WebTrader

cTrader

TradingView

|

ECN

ECN/STP

STP

|

f52b442a-bc26-439d-b423-e74a8eb76de7 | https://icmarkets.com/?camp=1516 | ||||||

| Submit Review | 0 |

Comoros - KM MISA |

4.6

Excellent

|

10 | 1000 |

cTrader

MT5

|

ECN

STP

|

Forex

Shares

Indices

Bonds

Cryptocurrencies

|

4d6c9c99-02e3-4008-9631-4912b38039e5 | https://zforex.com/?contractNo=13140300 | ||||||

| Submit Review | 0 |

Mauritius - MU FSC |

4.5

Excellent

|

50 | 500 |

MT5

WebTrader

MT4

|

NDD

|

0d52ed0e-fa0c-4b36-a893-ae4c404f21d8 | https://secure.keytomarkets.com/links/go/7250 | |||||||

| Submit Review | 0 |

Cyprus - CY CYSEC Mauritius - MU FSC South Africa - ZA FSCA Seychelles - SC FSA |

4.2

Good

|

10 | 3000 |

MT4

MT5

|

|

Forex

Shares

Indices

Oil/Energies

Cryptocurrencies

Metals

|

cc0ab73a-4fdf-4e02-a410-b2e40c46e8d1 | https://justmarkets.com/?utm_source=cashbackforex&utm_medium=pr&utm_campaign=review | ||||||

| Submit Review | 0 |

Australia - AU ASIC Cyprus - CY CYSEC |

4.6

Excellent

|

30 | 2000 |

Bank Wire

Credit/Debit Card

Neteller

Skrill

Crypto wallets

|

MT4

MT5

|

|

Forex

Shares

Indices

Oil/Energies

Cryptocurrencies

Metals

|

d97b88d2-1299-4111-bdbc-8fbe1f1813b8 | https://www.fisg.com/en/landing/universal?link_id=Ff38st6Rn&referrer_id=fZUFRCvgM | interstellarfx.eu | ||||

| Submit Review | 0 |

4.5

Excellent

|

4.5

Excellent

|

0 | 2000 |

MT4

MT5

Proprietary

|

ECN

|

3577b7f9-86ba-494c-9895-d3bf0ef95136 | https://www.tradetaurex.com/?utm_campaign=12370133-CBFX-Taurex-Review&utm_source=CBFX-Website&utm_medium=Visit-Taurex-CTA | |||||||

| Submit Review | 0 |

Australia - AU ASIC |

4.5

Excellent

|

50 | 1000 |

MT4

MT5

|

|

d9dbb4ea-5558-41ff-9ea4-38803a0fea3d | https://www.switchmarkets.com/?utm_source=fxverify&utm_medium=referral&utm_campaign=fxverify-referral-listing&utm_term=fxverify-referral-listing&utm_content=listing | switchmarkets.eu | ||||||

| Submit Review | 0 |

Australia - AU ASIC Cyprus - CY CYSEC Vanuatu - VU VFSC |

1.0

Poor

|

5 | 1000 |

|

MT4

MT5

WebTrader

|

|

3c14fe1d-3a09-4069-9437-7941ba8414dd | https://vc.cabinet.oneroyal.com/links/go/14476 | ||||||

| Submit Review | 0 |

Australia - AU ASIC Cyprus - CY CYSEC United Kingdom - UK FCA Seychelles - SC FSA Jordan - JO JSC |

4.5

Excellent

|

5.0

Excellent

|

100 | 1000 |

MT4

WebTrader

MT5

|

MM

|

c0422d7c-0530-482d-89cf-20b8d12f54b6 | https://admiralmarkets.onelink.me/7Buw/u9tvsp79 | admiralmarkets.com admirals.com partners.admiralmarkets.com | |||||

| Submit Review | 0 |

Cook Islands - CK FSC Comoros - KM MISA |

4.5

Excellent

|

5.0

Excellent

|

100 | 3000 |

Credit/Debit Card

Perfect Money

Crypto wallets

|

MT4

MT5

WebTrader

|

NDD/STP

ECN/STP

NDD

MM

|

dc76816b-b08e-4831-beff-4816a544bb8b | https://amarkets.com | amarkets.com amarkets.org main.amarkets.life | ||||

| Submit Review | 0 |

Australia - AU ASIC United Kingdom - UK FCA United Arab Emirates - AE DFSA |

4.6

Excellent

|

5.0

Excellent

|

0 | 500 |

MT4

WebTrader

|

STP

|

4d632264-64e6-4f2e-ac5a-559f5387d229 | https://www.axiedge.site/en-my/live-account?promocode=4719055 | axi.com | |||||

| Submit Review | 0 |

Australia - AU ASIC Cyprus - CY CYSEC United Kingdom - UK FCA |

4.0

Good

|

5.0

Excellent

|

100 | 500 |

MT4

MT5

WebTrader

|

ECN/STP

|

0153312a-810d-4b8d-9646-95ec403da3d3 | https://fxopen.com?agent=XX96FXPNXXB5192510002 | ||||||

| Submit Review | 0 |

Belize - BZ FSC |

4.5

Excellent

|

5.0

Excellent

|

10 | 2000 |

MT4

MT5

WebTrader

Proprietary

|

ECN

MM

STP

|

Forex

Shares

Indices

Oil/Energies

Metals

ETFs

|

5e837e4b-b2f2-4dac-9a2c-e6df097fa006 | http://www.roboforex.com/?a=fvsr | |||||

| Submit Review | 0 |

Australia - AU ASIC Cyprus - CY CYSEC United Kingdom - UK FCA Japan - JP FSA South Africa - ZA FSCA Seychelles - SC FSA |

3.5

Good

|

5.0

Excellent

|

0 | 2000 |

MT4

MT5

Proprietary

|

MM

NDD

|

912e2734-ba9e-4d0e-9e46-e06c09c2a44e | https://welcome-partners.thinkmarkets.com/afs/come.php?atype=1&cid=4926&ctgid=1001&id=4944 | thinkmarkets.com | |||||

| Submit Review | 0 |

Cyprus - CY CYSEC United Kingdom - UK FCA South Africa - ZA FSCA United Arab Emirates - AE DFSA Seychelles - SC FSA |

4.8

Excellent

|

5.0

Excellent

|

100 | 1000 |

MT4

MT5

WebTrader

|

STP

STP DMA

NDD

|

c73431db-9914-4932-abf0-9be9cf8967de | https://tickmill.com?utm_campaign=ib_link&utm_content=IB42043247&utm_medium=Tickmill&utm_source=link&lp=https%3A%2F%2Ftickmill.com%2F | tickmill.com/eu tickmill.com/uk | |||||

| Submit Review | 0 |

Malta - MT MFSA Cayman Islands - KY CIMA Malaysia - LB FSA |

4.5

Excellent

|

5.0

Excellent

|

0 | 400 |

cTrader

MT4

WebTrader

Proprietary

MT5

|

ECN/STP

|

af4f2b67-f4b8-4aca-90d3-8a3cc3b4aeca | https://www.tradeviewforex.com/?ib=1263 | ||||||

| Submit Review | 0 |

Cyprus - CY CYSEC United Kingdom - UK FCA Belize - BZ FSC |

4.1

Good

|

5.0

Excellent

|

1 | 0 |

Bank Wire

Credit/Debit Card

PayPal

PaySafeCard

Skrill

|

MT4

|

|

fbbb741f-49d8-40b6-b194-23b0688a857b | https://xtb.com | |||||

| Submit Review | 0 |

Cyprus - CY CYSEC South Africa - ZA FSCA |

4.3

Good

|

4.9

Excellent

|

50 | 500 |

MT4

MT5

Proprietary

|

ECN

NDD

|

Forex

Shares

Indices

Oil/Energies

Cryptocurrencies

Metals

|

429a6b35-102a-4182-9b59-7a029704866b | https://global.fxview.com/register?refLink=NDg3&refRm=ODg%3D&utm_source=cbf_fxv&utm_medium=cbf_cta&utm_campaign=fxv_cbf_rvw&utm_id=911&utm_content=Fxview | fxview.com | ||||

| Submit Review | 0 |

Australia - AU ASIC Cyprus - CY CYSEC United Kingdom - UK FCA Bahamas - BS SCB |

4.5

Excellent

|

4.8

Excellent

|

100 | 500 |

MT4

MT5

WebTrader

TradingView

|

MM

|

Forex

Shares

Indices

Oil/Energies

Cryptocurrencies

Metals

|

342df51d-6485-4d49-9725-5d845c75a780 | https://join.eightcap.com/visit/?bta=36849&nci=5523 | |||||

| Submit Review | 0 |

Mauritius - MU FSC South Africa - ZA FSCA Seychelles - SC FSA Virgin Islands, British - BVI FSC Kenya - KE CMA Curacao - CW CBCS |

4.4

Good

|

4.8

Excellent

|

1 | 0 |

MT4

MT5

WebTrader

|

MM

|

Forex

Shares

Indices

Oil/Energies

Cryptocurrencies

Metals

|

2c00b437-86ec-4622-95c0-d3df8ea3c52f | https://one.exness.link/a/uku889th | one.exness.link exness.com | ||||

| Submit Review | 0 |

Australia - AU ASIC Cyprus - CY CYSEC Mauritius - MU FSC South Africa - ZA FSCA Seychelles - SC FSA |

4.4

Good

|

4.8

Excellent

|

100 | 500 |

cTrader

MT4

MT5

WebTrader

|

ECN/STP

|

9b8f1812-d743-4ce5-8e2d-b88fba8b016d | https://fpmarkets.com/?fpm-affiliate-utm-source=IB&fpm-affiliate-pcode=14908&fpm-affiliate-agt=14908 | www.fpmarkets.eu www.fpmarkets.com/int | |||||

| Submit Review | 0 |

Australia - AU ASIC Cyprus - CY CYSEC Belize - BZ FSC United Arab Emirates - AE DFSA |

4.3

Good

|

4.8

Excellent

|

5 | 1000 |

Bank Wire

China Union Pay

Credit/Debit Card

Neteller

Skrill

|

MT4

MT5

WebTrader

|

MM

|

Futures

Forex

Indices

Oil/Energies

Metals

Soft Commodities (coffee, sugar...)

|

7641f3e1-ad2e-446a-bee8-20cd02ceff59 | https://www.xm.com/gw.php?gid=222661 | xmglobal.com xm.com/au | |||

| Submit Review | 0 |

Seychelles - SC FSA |

4.5

Excellent

|

4.7

Excellent

|

10 | 1000 |

AstroPay

Bank Wire

Credit/Debit Card

Perfect Money

ZotaPay

|

MT5

Proprietary

|

STP

|

54f986ae-523b-48ac-b6e0-84dcaf56825f | https://fxcentrum.com/homepageref/ | fxcentrum.com | ||||

| Submit Review | 0 |

Australia - AU ASIC Vanuatu - VU VFSC |

4.3

Good

|

4.7

Excellent

|

0 | 500 |

MT4

|

ECN

STP

|

Forex

Shares

Indices

Bonds

Oil/Energies

Metals

|

7fb80890-6fdc-491b-8f18-766d663f4fdc | https://globalprime.com/?refcode=82302 | |||||

| Submit Review | 0 |

Cyprus - CY CYSEC Seychelles - SC FSA |

4.5

Excellent

|

4.7

Excellent

|

100 | 500 |

Bank Wire

Credit/Debit Card

Neteller

Skrill

Revolut

Wise

|

cTrader

MT4

MT5

|

ECN/STP

|

5f1b7412-0545-4d37-9933-9cb18ff09c4f | https://oqtima.com/?r_code=IB0318050056A&expiry_date=Nw== | oqtima.eu oqtima.com | ||||

| Submit Review | 0 |

Comoros - KM MISA |

3.8

Good

|

4.7

Excellent

|

0 | 1000 |

MT4

MT5

|

NDD/STP

MM

ECN/STP

ECN

|

Forex

Shares

Indices

Oil/Energies

Cryptocurrencies

Metals

|

14fc8dc7-aa48-4a5d-abe7-21a3eff00e4c | https://go.xchief.com/27c7c1 | xchief.com | ||||

| Submit Review | 0 |

Vanuatu - VU VFSC |

4.5

Excellent

|

4.6

Excellent

|

25 | 500 |

|

MT4

Allpips

|

ECN/STP

|

Forex

Indices

Cryptocurrencies

Metals

|

b8c397e4-0f15-473a-8363-15abc55fa713 | https://adrofx.com?refid=50835fb6-927e-49fe-93ce-4ce9e8d052c7 | ||||

| Submit Review | 0 |

South Africa - ZA FSCA Vanuatu - VU VFSC Seychelles - SC FSA Cyprus - CY CYSEC |

4.3

Good

|

4.6

Excellent

|

5 | 5000 |

Bank Wire

Credit/Debit Card

SticPay

Bitwallet

|

MT4

MT5

|

MM

|

Forex

Shares

Indices

Oil/Energies

Cryptocurrencies

Metals

|

d8972172-ef64-4a4b-9640-42908dfa3b34 | https://fxgt.com/?refid=24240 | ||||

| Submit Review | 0 |

United Kingdom - UK FCA Mauritius - MU FSC Kenya - KE CMA |

4.2

Good

|

4.6

Excellent

|

500 | 2000 |

MT4

MT5

WebTrader

|

ECN

|

Forex

Shares

Indices

Oil/Energies

Metals

Soft Commodities (coffee, sugar...)

|

f2d49fdd-de81-4827-9364-9337b4a02935 | https://www.forextime.com/?partner_id=4900292 | |||||

| Submit Review | 0 |

South Africa - ZA FSCA Seychelles - SC FSA |

2.8

Average

|

4.6

Excellent

|

50 | 1000 |

|

MT4

MT5

WebTrader

Proprietary

|

STP

ECN

|

338ea710-df08-42d1-b2ff-0a6087bfce79 | https://go.monetamarkets.com/visit/?bta=37266&nci=5342 | monetamarkets.com | ||||

| Submit Review | 0 |

Australia - AU ASIC South Africa - ZA FSCA |

3.5

Good

|

4.6

Excellent

|

100 | 500 |

MT4

MT5

WebTrader

|

STP

NDD

ECN

|

d28bf92d-7357-4b61-a5ac-5eaddd838ca6 | https://www.vtmarkets.com/?affid=840375 | vtaffiliates.com | |||||

| Submit Review | 0 |

Australia - AU ASIC Vanuatu - VU VFSC |

No Rating

|

4.5

Excellent

|

200 | 500 |

MT4

MT5

WebTrader

|

MM

|

40739c1e-8ffd-4ea0-b731-e48e0728de11 | https://clients.fxtrading.com/referral?r_code=IB01877918B | ||||||

| Submit Review | 0 |

United Kingdom - UK FCA Bahamas - BS SCB |

4.3

Good

|

4.5

Excellent

|

100 | 200 |

MT4

WebTrader

cTrader

MT5

Proprietary

|

NDD

|

fd8b4daa-93af-463a-bcc1-a87d61051568 | https://www.fxpro.com/?ib=IBX01575 | ||||||

| Submit Review | 0 |

Vanuatu - VU VFSC |

3.2

Average

|

4.5

Excellent

|

1 | 1000 |

MT4

MT5

|

|

17360490-acb1-4eb6-9786-92571e153503 | https://www.n1cm.com/?partner_id=244132 | ||||||

| Submit Review | 0 |

Japan - JP FSA Greece - EL HCMC |

4.5

Excellent

|

4.5

Excellent

|

0 | 500 |

|

Proprietary

|

MM

STP

|

Forex

Shares

Indices

Cryptocurrencies

|

f82e9f2a-24bd-4860-9ecc-0a9ad800d76e | https://zulutrade.com/ | zulutrade.com zulutradejapan.com | |||

| Submit Review | 0 |

Australia - AU ASIC Cyprus - CY CYSEC Belize - BZ FSC |

4.6

Excellent

|

4.4

Good

|

5 | 3000 |

MT4

MT5

Proprietary

|

NDD/STP

|

b2fdf5bf-3db4-495e-91eb-798f32f230f5 | https://fbs.partners?ibl=794494&ibp=33121722 | fbs.com | |||||

| Submit Review | 0 |

Australia - AU ASIC Cyprus - CY CYSEC Mauritius - MU FSC Seychelles - SC FSA |

4.5

Excellent

|

4.2

Good

|

200 | 500 |

cTrader

MT4

MT5

WebTrader

|

ECN/STP

|

Forex

Shares

Indices

Oil/Energies

Cryptocurrencies

Metals

|

2298df51-515c-4ec9-b8a4-b91464860e4d | https://www.gomarkets.com/en/?Pcode=1100048 | gomarkets.eu int.gomarkets.com gomarkets.com/au | ||||

Lowest Spread Forex Brokers

In forex trading a low spread is crucial, not only to give traders a more favourable entry price, but also important for those employing scalping or hedging strategies. Thus, a 0 pip spread is the perfect spread for both strategies.

But above all, spreads are an important part of the overall trading costs. This means smaller spreads, more profit for traders. To find one of the best lowest spread forex brokers for your strategy, check out our comparison table, sorted by pricing rating.

The pricing rating is how our industry experts rate each broker's spreads and overall cost of trading. This also includes trading commissions, deposit and withdrawal fees, and other charges.

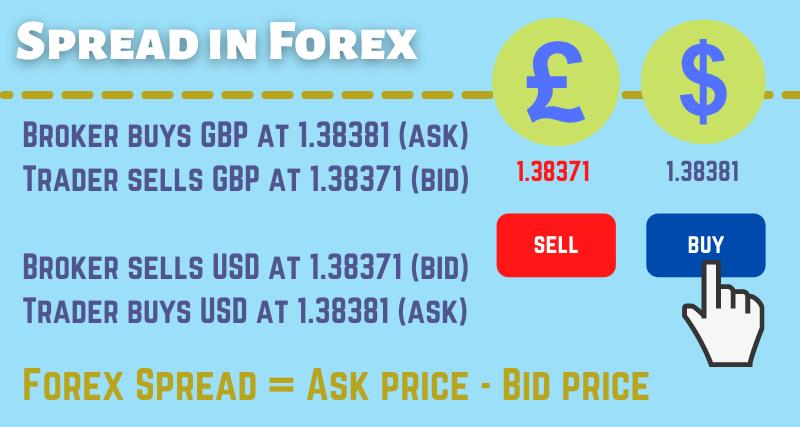

What is the Spread in Forex?

The spread in forex is the difference between the bid and the ask price, for each single currency pair. This value (the spread) is also the profit of the forex brokers, who buy the base currency at bid price (lower) and sell the quote currency at ask price (higher).

A practical example of a forex broker spread for the GBP/USD pair, and from the trader’s perspective, would be:

- Buy price (ask price) 1.38381 vs sell price (bid price) 1.38371 = spread 1 pip.

This means that the broker is willing to buy the base currency (GBP) from the trader at 1.38371 (bid price) in exchange for selling the quote currency (USD) to trader at 1.38381 (ask price).

By selling at a higher price and buying at a lower price, the broker makes a profit on the spread. Because traders always buy at a higher price, and sell at a lower price, this also means that investors will, invariably, start a trade always in loss.

Of course, if the spread would be 0 pip, a trader could open and close a position on the same instant, without a profit, or a loss. But in reality, this is impossible. ECN forex brokers market their spreads "as low as 0 pip", but there's also trading commissions added to the total cost of opening a trade.

- For traders, a currency pair real trading cost is the broker’s spread plus the trading commissions.

These commissions are normally calculated in USD, and they have the equivalent value in pips. For example, 1 pip is 10 USD on a standard forex lot (100,000 currency units).

As we saw above, ECN brokers advertise a 0 pip spread on the EUR/USD pair, but charge a trading commission, usually, 7 USD per 1 round lot. So, a trader opening a buy position of 1 lot at 1.20565 will only reach breakeven if the price goes up to 1.20572 (up by 0.7 pip).

Comparatively, a broker offering a 0.6 pip spread on the EUR/USD pair without commissions, is cheaper to trade with than an ECN broker offering a 0.2 pip spread, but charging a trading commission of 7 USD on the same pair. The total spread with the ECN broker would be 0.9 pip.

Trading commissions in USD can be easily converted in pips (1 pip size is 0.0001), to find out how many pips the price needs to move to reach breakeven (or to know the real spread cost). For that, simply use the following formula:

To find out what would be the brokers’ commissions for different size lots, (assuming a 7 USD commission), simply divide the broker’s commission by 10. Then multiply the currency units of the trading position by the commission in pip size, or, check the table below:

| Lot Size | Currency Units | Commission in Pip | Commission in USD |

|---|---|---|---|

| 0.01 | 1,000 | 0.00007 | 0.07 |

| 0.10 | 10,000 | 0.00007 | 0.70 |

| 1 | 100,000 | 0.00007 | 7 |

| 10 | 1,000,000 | 0.00007 | 70 |

How to Lower Your Broker Spreads

There’s a way, legal by all means, that thousands of traders use to lower even more the broker’s spreads. Even with ECN brokers with a 0 pip spread, and charging trading commissions.

As we saw above, the trading commissions can also be converted in pip size and value. Clever traders are taking advantage of forex rebates programs, like the one offered by our site.

Forex rebates allows traders to reduce their trading costs and spreads. But at the same time, to earn extra cash from trades, regardless if a trade is closed in profit or loss.

Forex rebates are a cashback program offered by a third-party provider, linked to a forex trading account, and paying a cash rebate for each closed trade.

The cash rebate is a portion of the transaction cost, spread or commissions, or a combination of both, that is paid back to the client on each trade. This results in lower spreads, and above all, an improved win ratio for the trader.

- For example, if the rebate from the broker is 0.3 pip for the GBP/USD pair, and the typical spread is 0.8 pip, then the net spread for the trader is only 0.5 pip.

Also, there is no "catch". The broker spreads will never increase as a result of using a rebates service! In the end, trading via a rebates provider will result in lower spreads, period. And of course, it is more beneficial to a trader’s financial position to work via a rebates provider than solely with the forex broker.

To find a complete list of all the brokers, linked to our cashback program and paying rebates, we recommend a quick visit to our Brokers Page. We have several partnerships with brokers paying rebates on forex and cryptocurrencies trades.