Best ECN Brokers in 2026, with Verified Users Rating

| Broker | Submit Review | Forum Posts | Regulation | User Rating | Popularity | Minimum deposit | Maximum leverage | Funding Methods | Trading platforms | Negative balance protection | Regulatory deposit insurance | Account currency | Execution model | Asset classes | Languages | d0cbfa30-9797-4e3f-a6f5-33d1658ea3de |

|---|

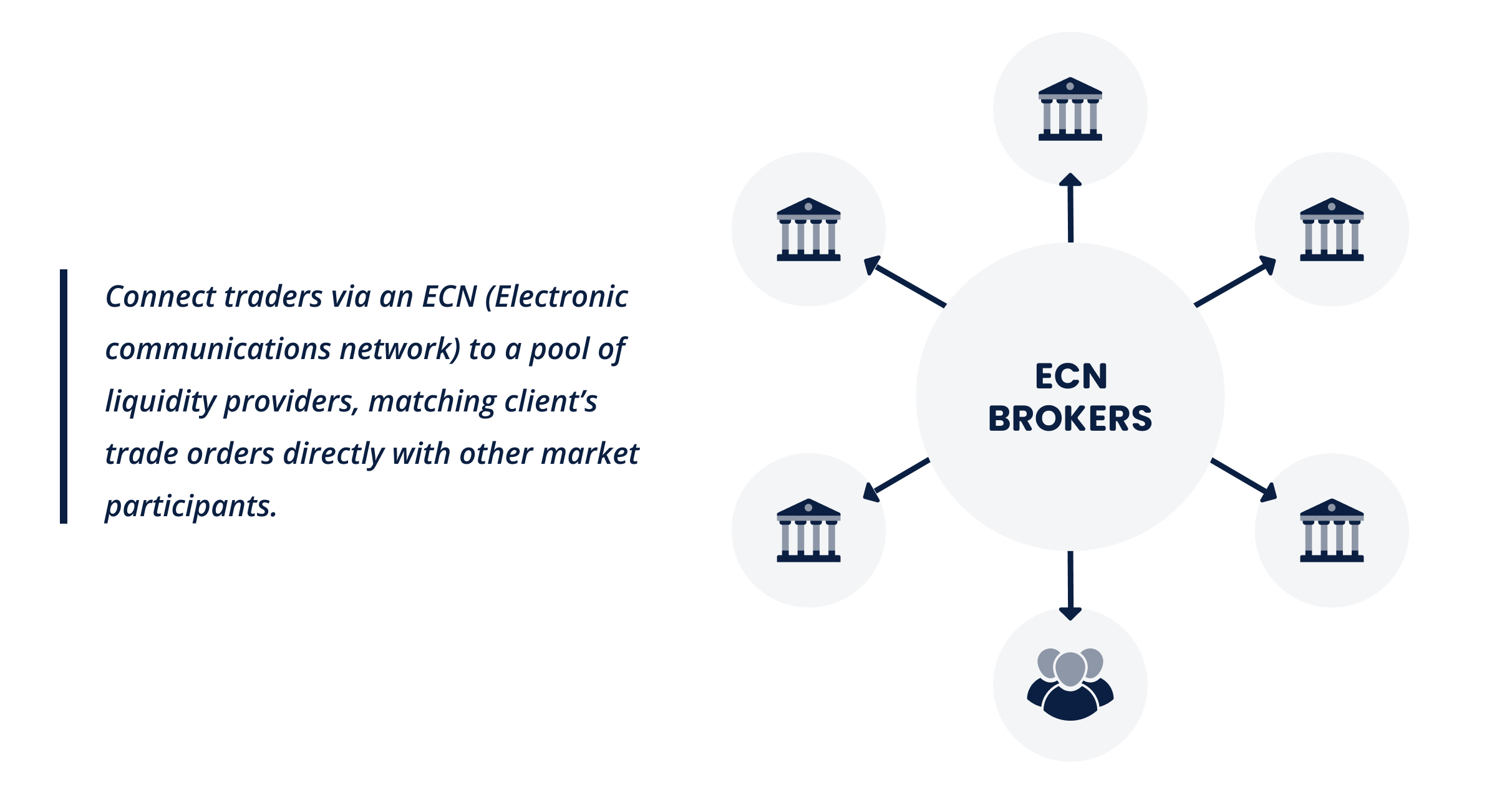

What is the ECN?

ECN is the acronym of Electronic Communications Network. Retail ECN forex brokers connect via these networks to match clients’ orders directly with other market participants. Or a pool of liquidity providers, normally, banks.

The edge, in principle, of trading with an ECN forex broker, is the direct access to the foreign exchange market, without a middleman.

The distinguishing feature of ECN brokers, when compared to Market Maker brokers, is that there isn’t an intrinsic conflict of interest. Contrarily to a Market Maker broker operating a dealing desk model, and taking the opposite side of the client’s trades, the ECN broker passes the orders to liquidity providers.

Unlike a Market Maker broker, which profits on its clients' losses, ECN brokers make their profits every time their clients' trade, by charging a trading commission.

Best ECN Brokers Main Features

| Features | ECN Brokers | ECN Modelling Brokers |

|---|---|---|

| Small initial deposit | ||

| High leverage available | ||

| Micro lots (0.01) | ||

| Mini lots (0.10) | ||

| Low spreads | ||

| Commissions | ||

| Fast execution |

A forex ECN is a trading system allowing the routing of an order from one trader to another member of the ECN network. The forex ECN eco-system was originally developed as a network, connecting and pushing orders to the market.

One of the many features of the ECN network is the impossibility of interference with the orders, or with the market spreads from the liquidity providers. Thus, ECN brokers can only make a profit, mainly, from commission fees.

- The ECN forex broker routes orders to the FX market liquidity providers. The quoted prices (the highest bid and the lowest ask) displayed on the broker trading platform, are not from the broker itself, but from the liquidity providers.

Many CFD brokers often advertise the offering of ECN accounts, but in reality, they don’t. What they offer is an ECN pricing model account. In this case, orders are not passed to the FX market, where the big banks and investment firms wage war on each other. On the real FX market, every minute, and every second, banks are exchanging, not mini-lots of 1,000 units of a currency, on a 500:1 leveraged account, but contracts worth millions and millions of dollars.

The not-so-true-ECN-broker might be quoting the prices from the ECN network, but this broker is not an ECN broker. It is in reality an STP broker (Straight Through Processing), basically the middleman between the traders and the liquidity providers.

The STP brokers negotiate the trading positions with the liquidity providers. They will then gather several retail trades, in a block, and offer them to a liquidity provider willing to take the trades from those retail orders. And sometimes, these secondary LPs can also be a Market Maker broker!

Since operating in the ECN network is an expensive venture in terms of fees, an ECN broker offering a direct trading channel between investors and liquidity providers, will have high-service fees to pay as well. That’s why, usually, the best ECN brokers demand larger initial deposits when opening an account and offer smaller leverage ratios.

The other main difference, always related to the high-service costs of operating via the ECN network, is the minimum position size. This is a requirement imposed by most ECN liquidity providers. These important market players often have a minimum position size of 0.1 lots (10,000 currency units). Thus, it will be impossible for traders to open smaller positions, like a 0.01 lot (1,000 currency units).

Also, since ECN brokers can’t interfere or make a profit with the spread (the highest bid and the lowest ask from the liquidity providers), they have fixed commissions and fees for each transaction. And usually, those commissions and fees are considerably large, as it is the only source of income of an ECN broker.

So, if you are keen on trading with a True ECN FX broker, it is important to identify who are the real ECN brokers that can operate solely (and without any further interests), as intermediaries between traders and the real market.

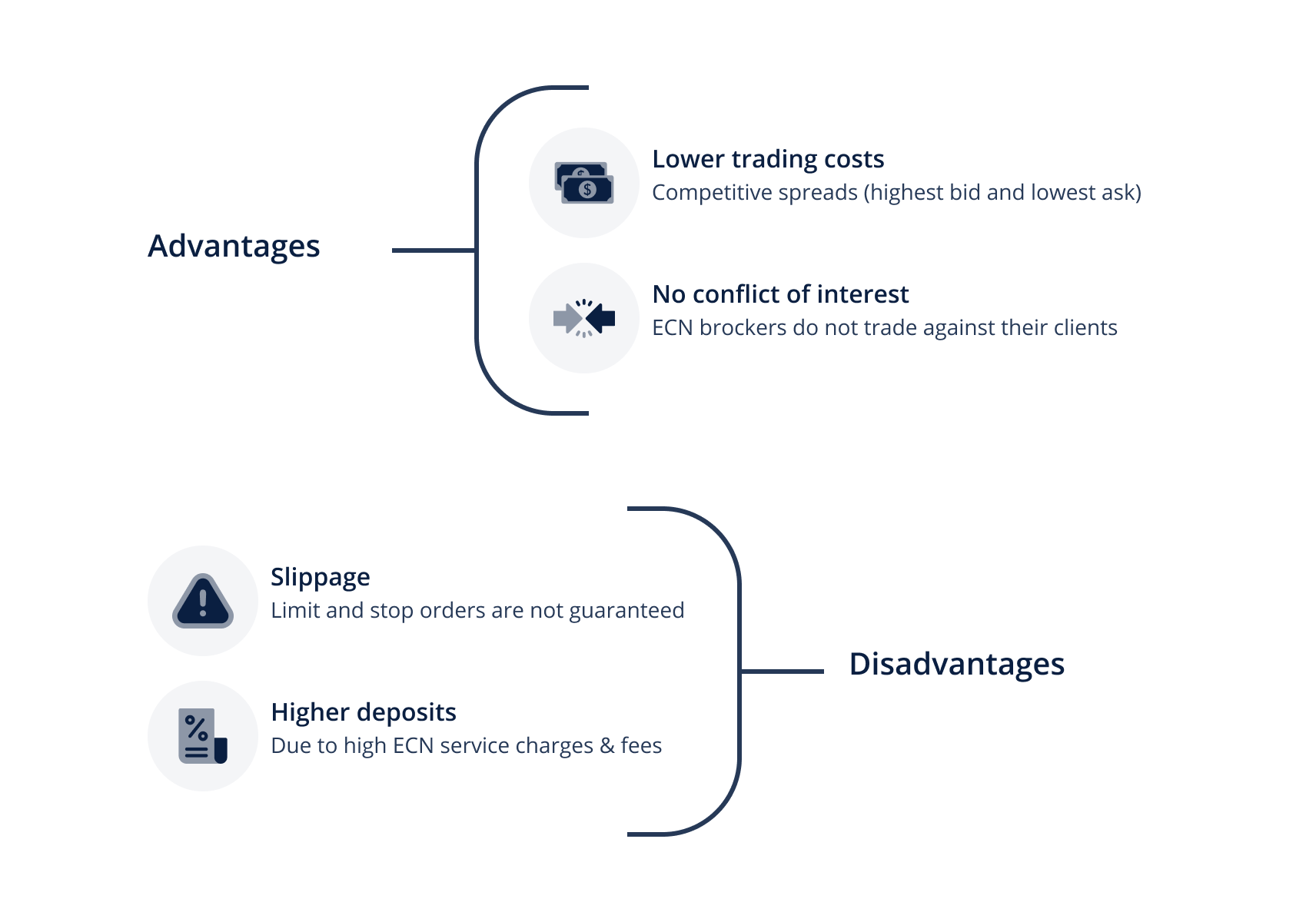

Pros of Trading on an Electronic Communications Network

- Deep Liquidity: ECN brokers give clients direct access to the market and deep liquidity pools, where the key players, banks and other financial firms, operate.

- Lower Trading Costs: ECN brokers connect traders directly to the best market quotes and the most competitive spreads (highest bid and lowest ask), often 0.0 pips.

- No Conflict of Interest: ECN brokers do not trade against clients. Instead, they facilitate direct access to the market and the institutional liquidity providers.

Cons of Trading on an Electronic Communications Network

- Guaranteed Execution: Due to the characteristic high volatility of the forex market, slippage (positive and negative) can happen when trading with an ECN broker. This means that a limit, or a stop order, might be filled at a different price than set. It also means that stop-loss levels are not guaranteed.

- Small Account Deposits: Most ECN brokers require larger deposits to open an ECN trading account. This is related to the high costs and services fees of the ECN network.

- Small Position Size: You need money to make money. Again, related to service costs of the ECN network, most liquidity providers impose a minimum position size of 0.1 lots (10,000 currency units). This means trade sizes of mini lots of 1,000 currency units (or even nano lots) are commonly not available.

- High Leverage Ratios: ECN brokers are supervised by tier 1 regulatory bodies and follow strict rules regarding leverage ratios. It is common for ECN brokers to limit the available leverage to 30:1 for retail investors.

Final Considerations

As the ECN trading modelling is far more attractive to retail investors, with lower spreads, several retail brokers market themselves as ECN forex brokers. Unfortunately, there are several brokers taking advantage of this, and they are just using the ECN modelling as a marketing strategy to attract new customers.

These brokers are not true ECN forex brokers. They are only ECN pricing model brokers, offering ECN accounts type, with a lower spread, plus trading commissions.

But the underlying difference is that the trading activity is not passed directly to the main liquidity providers on the ECN network. Instead, these so-called ECN forex brokers will act as the middlemen to the liquidity providers. Or, it could be a Market Maker broker where the trading activity occurs on the broker’s pool of liquidity.