What are Pips in Forex

Data is continually updated by our staff and systems.

Last updated: 10 Feb 2021

We earn commissions from some affiliate partners at no extra cost to users (partners are listed on our ‘About Us’ page in the ‘Partners’ section). Despite these affiliations, our content remains unbiased and independent. We generate revenue through banner advertising and affiliate partnerships, which do not influence our impartial reviews or content integrity. Our editorial and marketing teams operate independently, ensuring the accuracy and objectivity of our financial insights.

Read more about us ⇾

Pip is the acronym for “percentage in point” or “price interest point”. Pips, in Forex CFDs trading, are used to measure the price action of a currency pair.

A currency pair pip is the last decimal point of the currency quote, equivalent to 1/100 of 1%, or, one basis point.

- For currency pairs with 4 decimals, 1 pip = 0.0001

- For Yen based currency pairs with 2 decimals, 1 pip = 0.01

- When trading metals, Gold and Silver, 1 pip = 0.01

- For Forex CFDs brokers displaying quotes in 5-decimal format, the last decimal is 0.00001, or 0.001 for Yen based currencies, and represents 1/10 (one tenth) of a pip

Table of Contents

Calculating Pips in Forex

The Interbank Forex rates for some currency pairs are quoted with four decimal places, while others quoted with only two. For a currency pair with four decimals, such as the Euro vs the US Dollar (EUR/USD), the pip indicates the lowest price change of the fourth, and last, decimal place.

Regarding currency pairs with two decimals, and for Yen based crosses, for example the Euro vs the Japanese Yen (EUR/JPY), the pip indicates the lowest price change of the second, and last, decimal place.

Thus, the EUR/USD price quote could be displayed as 1.1973 and a price move up to 1.1974 would represent 1 pip. If the price drops to 1.1972, that price change would also represent 1 pip.

Comparatively, the EUR/JPY price quote could be displayed as 126.47 and a price drop to 126.46 would represent 1 pip. The same way if the EUR/JPY price surges to 126.48, that move would also represent 1 pip.

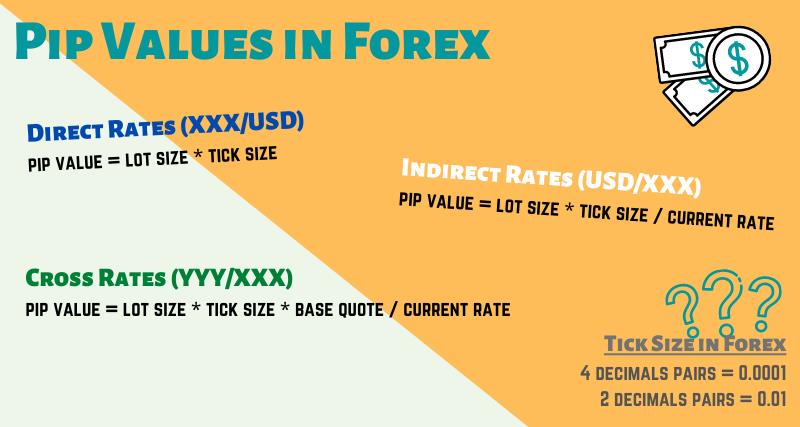

Pip values in Forex trading not only vary per currency pair, but also vary depending on the trade size. In other words, which currency is bought or sold, how many lots, or, how many individual units of a currency are traded, like a mini-lot in retail FX.

The easiest way for traders to calculate pip values in Forex is by using our Pip Value Calculator below. You can accurately get the pip values of several Forex pairs, cryptocurrencies crosses and metals. The results are calculated using live market quotes, your account base currency, the trade lot size and the traded currency pair.

Pips in Forex Trading

In Forex trading, currencies are always traded one against the other and a pip represents the smallest price move (up or down) of a currency pair. Pip is the measuring unit in Forex, gauging the displacements that a base currency makes when traded versus a quote currency, for example the EUR (base currency) versus the USD (quote currency).

When you enter a short EUR/USD trade, you are selling the Euro and buying the US Dollar. A currency cross is always composed of two currency symbols.

The first symbol of a currency cross is called the base currency and the second symbol is called quote currency. In an absolute sense, when we consider the value of the Euro in Forex trading at any given time, we always do so in relation to another currency, identifying the so-called "exchange rate", calculated in pips.

Pip Value in Forex

The quote currency of an FX cross and the lot size will determine the pip values in Forex trading. Depending on the traded lots (a standard lot is 100,000 currency units), and the currency traded, the pip has a certain monetary value. This means that the bigger the lot size, bigger the pip value, and bigger the profit, or the loss.

For example, for a micro lot of EUR/USD (1,000 currency units) the pip value is 0.10 USD. For a mini lot of EUR/USD (10,000 currency units) the pip value is 1 USD. And for a standard lot of EUR/USD (100,000 currency units) the pip value is 10 USD.

Here's a quick snapshot with the pip values for some of the most traded currency pairs:

| Currency Pair | Pip Value Percentage | Pip Value (1 Standard Lot) | Pip Value (0.10 Mini Lot) | Pip Value (0.01 Micro Lot) |

|---|---|---|---|---|

| EUR/USD | 0.0001 | 10 USD | 1 USD | 0.10 USD |

| EUR/GBP | 0.0001 | 10 GBP | 1 GBP | 0.10 GBP |

| EUR/JPY | 0.01 | 1,000 JPY | 100 JPY | 1 JPY |

| USD/CHF | 0.0001 | 10 CHF | 1 CHF | 0.10 CHF |

| USD/CAD | 0.0001 | 10 CAD | 1 CAD | 0.10 CAD |

| USD/JPY | 0.01 | 1,000 JPY | 100 JPY | 1 JPY |

When trading with an online Forex CFDs broker, the quotes are usually expressed in five decimals. As we saw on our example before, with a 5-digit broker, the EUR/USD price quote could be displayed as 1.19732 and the EUR/JPY price quote could be displayed as 126.476.

Thus, if the Euro/US Dollar exchange rate is expressed in five decimals, like EUR/USD = 1.19732, and the rate drops to EUR/USD = 1.19482 there's a price change of -25 pips (or 250 pipettes).

If instead the Euro/Yen exchange rate is expressed in three decimals, like EUR/JPY = 126.476, and the rate surges to EUR/JPY = 126.726 there's a price change of +25 pips (or 250 pipettes).

Fractional Pips in Forex CFDs Trading

When trading Forex CFDs with an online broker, the currency pair, or the exchange rate, is usually expressed in 5 decimals, or 3 decimals for Yen based currency pairs.

And this has become the norm with CFDs brokers, although there’s a still a few true to the market, and displaying the prices with 4 decimals and 2 decimals for the Yen based currency pairs.

Going back to 5-digit brokers, in the case of a currency pair with five decimals, for example the US Dollar vs the Swiss Franc (USD/CHF), the last digit indicates the lowest price change of a 0.1 pip.

Same is applied in the case of Yen based currency pairs, with three decimals, for example the Euro vs the Japanese Yen (EUR/JPY), where the last digit also indicates the lowest price change of a 0.1 pip.

As an example, with a 5-digit broker, the EUR/USD price quote could be displayed as 1.19732 and a price move up to 1.19737 would represent 0.5 pip.

For the EUR/JPY, the price quote could be displayed as 126.476 and a price move down to 126.472 would represent 0.4 pip.

Because of the extra digit, it is harder to eyeball an exact pip spread or pip profit without the aid of a calculator. But this eyeballing problem of the 5-digit brokers is outweighed by the larger advantage of typically better spreads, i.e., lower transaction costs, compared to their 4-digit broker counterparts.

Now that you understand what are pips in Forex, how pips measure currency crosses price action, the only thing left is to give a little advice. Before placing an order, it is good practice to calculate what could be the potential gain or loss of the investment. Not only regarding the trade R:R, but also considering the pip value of the cross you wish to trade.

About the author: John Lee Rossi

John Lee Rossi, currently head of fundamental and technical research with Clear Markets Ltd., is a seasoned trader with more than 16 years experience trading in the financial markets. John previously worked for several brokerage companies, operating in different OTC markets, specialising in a wide range of financial products, from Forex trading to commodities trading. Happily married to his lovely wife Frances, John has two teenage daughters. Away from the business, he enjoys hiking, golfing, and spending time at the Ozarks lake with family and friends.

John Lee Rossi, currently head of fundamental and technical research with Clear Markets Ltd., is a seasoned trader with more than 16 years experience trading in the financial markets. John previously worked for several brokerage companies, operating in different OTC markets, specialising in a wide range of financial products, from Forex trading to commodities trading. Happily married to his lovely wife Frances, John has two teenage daughters. Away from the business, he enjoys hiking, golfing, and spending time at the Ozarks lake with family and friends.